In this section, we look at what sort of businesses responded to the survey and answered either the online or postal questionnaire.

The answers to these first six questions also give us a good, overall picture of the wet leisure industry in the UK.

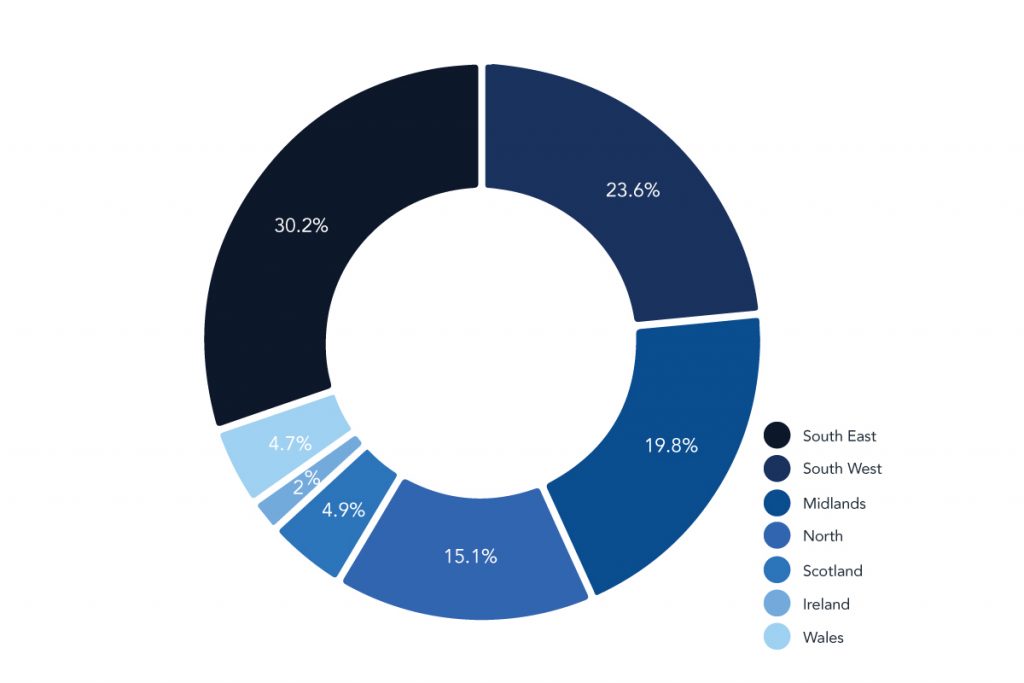

Which region of the UK does your business operate from?

This year’s responses came in from a slightly broader area than previous years with Wales, Scotland and the North all showing an increase. In fact Scotland and the North both doubled the number of businesses that took part in the survey compared to last year. Hopefully this is a sign of industry growth in those regions.

The South East, South West and the Midlands remain the dominant regions and that, to a large extent, reflects the relative strength of the overall economy in those areas.

If we look at government figures for disposable income across the country, they make a distinction between London and the rest of the South East with the capital accounting for more than half the wealth in the whole of the region.

Interestingly, when we look at the responses for the South East compared to the survey average, businesses in London and the South East are building and refurbishing a far higher percentage of pools in comparison to the industry average.

When we take a closer look at the South West another interesting picture emerges. Once again, pools have a higher than average importance but wet leisure businesses in the South West, although they report a few new builds, are mostly involved in refurbishment and service and much of that business comes from the commercial sector. This seems to fit quite neatly with the importance of tourism in the South West.

The Midlands, by contrast, is the home of the spa. Spa sales dominate the business in this region.

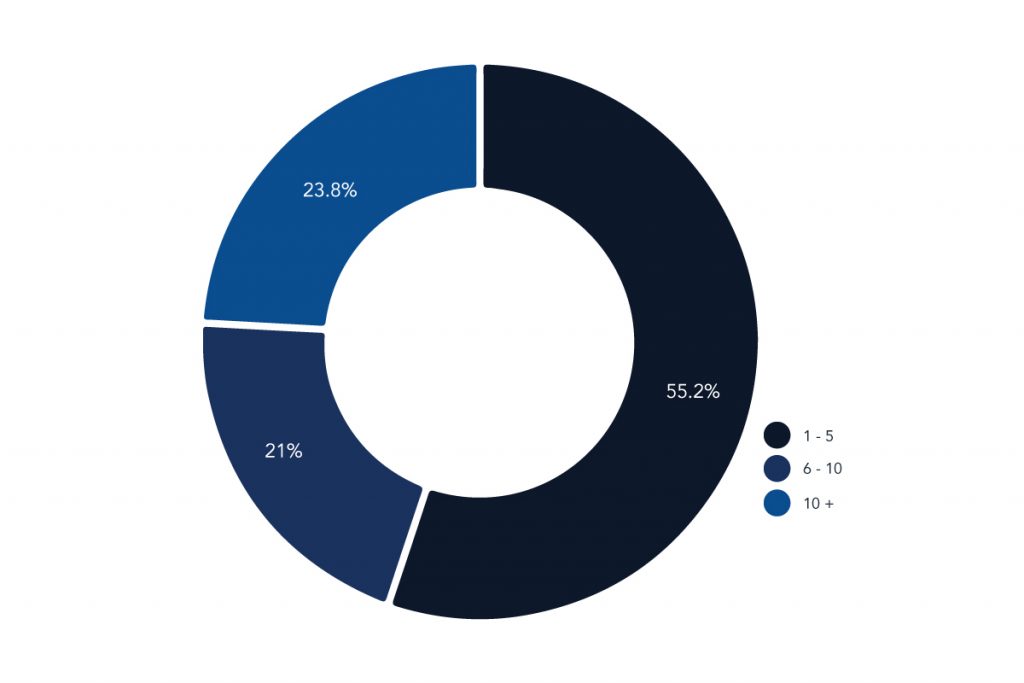

How many employees do you have in your business?

Over the last 6 years of the survey, businesses that employ less than 5 people have accounted for between 55% and 60% of the industry sample.

This year that figure is 55%.

When we look more closely at the bigger businesses, those employing more than 10 staff, we can see a number of areas where they differ from the industry sample average.

71% of these bigger companies offer showroom sales compared to the survey average of 52%. They are 50% more likely to be involved in e-commerce, 30% more likely to be using social media for their business and nearly twice as likely to have seen growth in the sauna market.

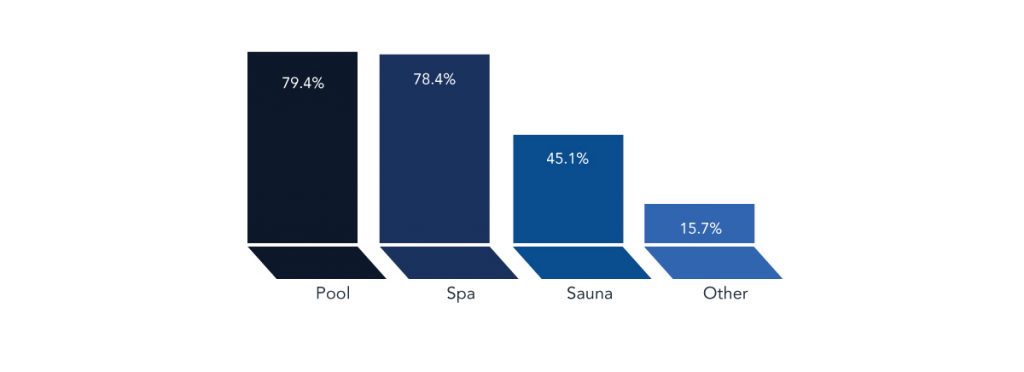

What sectors of the wet leisure industry do you serve?

Over the 6 years of the survey, spas and hot tubs have slowly been inching their way up the graph until, this year as last year, they sit equally in terms of importance with pools.

Of course, what we are measuring here is a percentage of overall business and the new parity between spas and pools could just as easily be explained by a decline in the amount of business that pools generate.

Certainly there is evidence to suggest that the number of new pool builds is down and more work is to be found in the refurbishment of existing pools.

In terms of ‘other’ areas, responses varied from equine hydrotherapy to bathrooms but once again, steam rooms and steam showers predominated.

In the last few years we have seen a pattern of diversification across the whole wet leisure industry; so where in the past there would be pool companies and spa retailers for instance, now most businesses would offer a choice of pool, spa or sauna and steam to their customers.

This led us not to examine those individual areas but, this year, we will take a closer look at each of those sectors. Those questions are towards the end of this report.

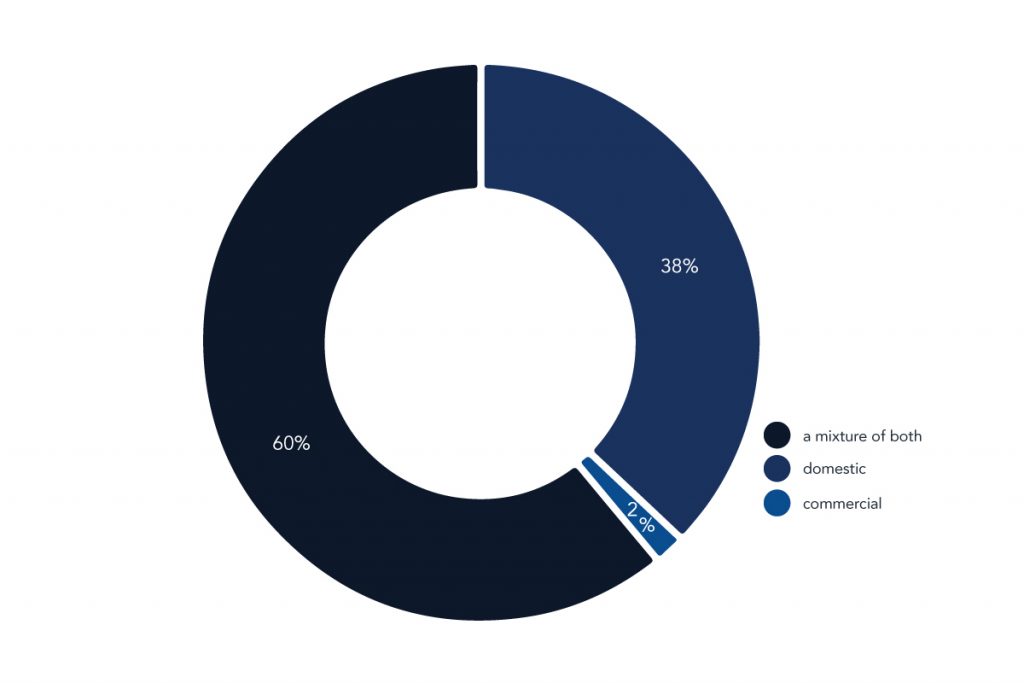

Are your customers and clients domestic, commercial or a mixture of both?

This years graph is identical to last years. We have to look all the way back to 2013 to see any difference when the purely commercial sector represented about 5% of the overall industry.

As UV water treatment and automated control systems become more common in domestic installations, LED lighting and stainless steel water features are increasingly specified for the commercial environment. Across the whole industry, the two sectors are coming closer and closer together.

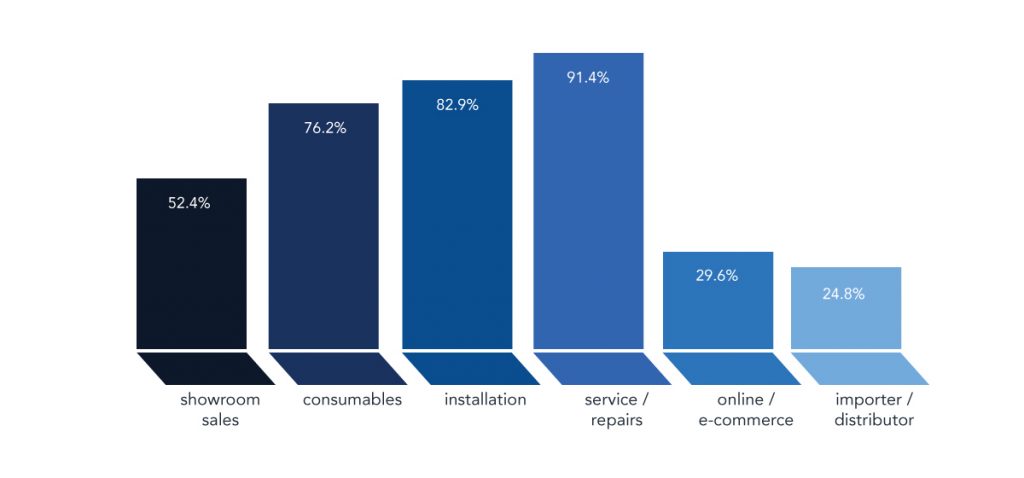

What are the services you offer your customers?

For the first year since the survey began, the number of respondents engaged in e-commerce has shown a slight increase.

Just a few percentage points up from last year’s figures and, at 29%, still a long way from the 2011 figure of almost 40%; an increase, all the same. And perhaps we shouldn’t be surprised as e-commerce as a sector across the whole UK economy is showing growth of 15% year on year.

At well over 90%, service and repairs continues to be the most important sector of the wet leisure industry.

This sector will include commercial service contracts and pool refurbishments, two growth areas that can offer good turnover to any business. Add to that the increasing complexity of modern domestic installations and the relative demise of the UK’s DIY culture and it is easy to see how this area has become so strong.