The first 6 questions are designed to give an idea of what sort of businesses answered the survey. In doing so, they also give a good, overall picture of the wet leisure industry.

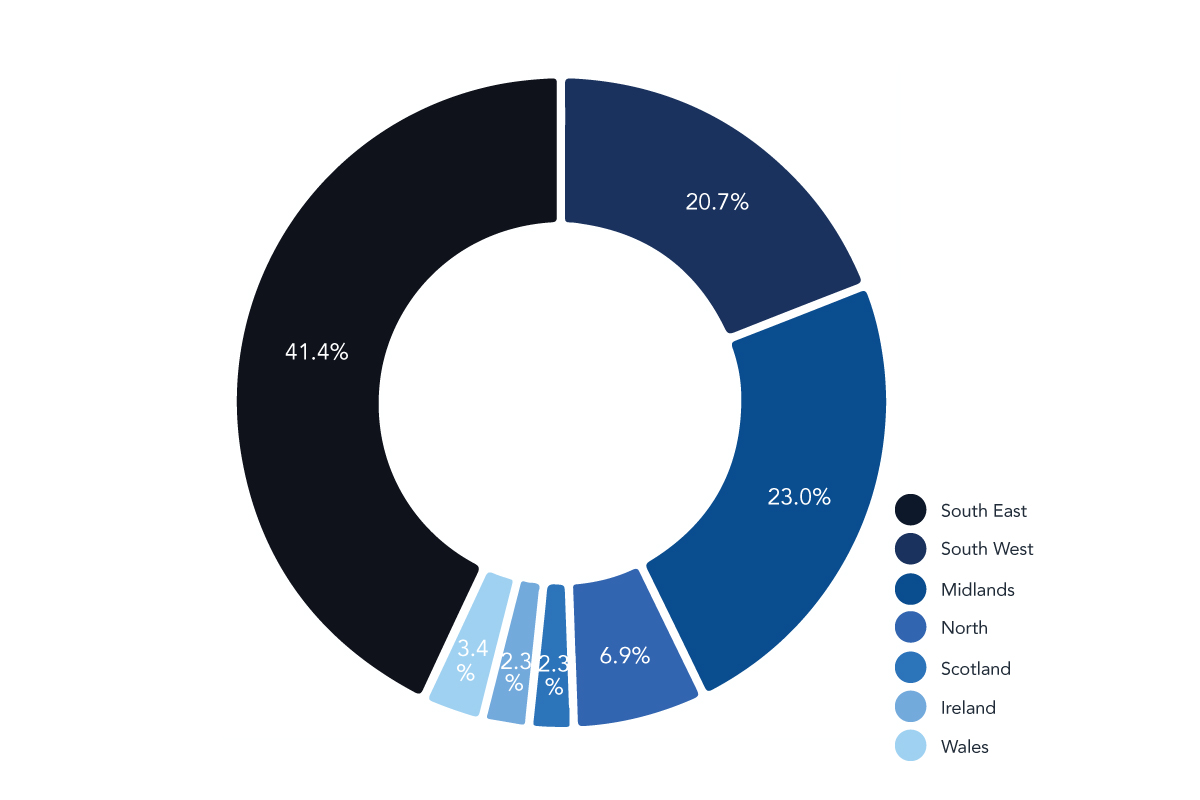

Which region of the UK does your business operate from?

The South East, Midlands and the South West remain the most strongly represented regions. Over the course of the last five years they have accounted for 85% of the survey responses.

If that is put in context of the UK economy, it comes as no surprise. These three regions are the most economically powerful. Government surveys regularly show that they have the highest levels of disposable income and the most buoyant house prices.

Having said that, Scotland has a strong economy and good levels of disposable income and yet, over the 5 years, has never accounted for more than 5% of the survey responses.

There is some evidence to suggest that the tourism and leisure industry in Scotland may be starting to spread the popularity of wet leisure products in the country with more and more hotels, health clubs and holiday rental properties installing pools, saunas and, particularly, spas.

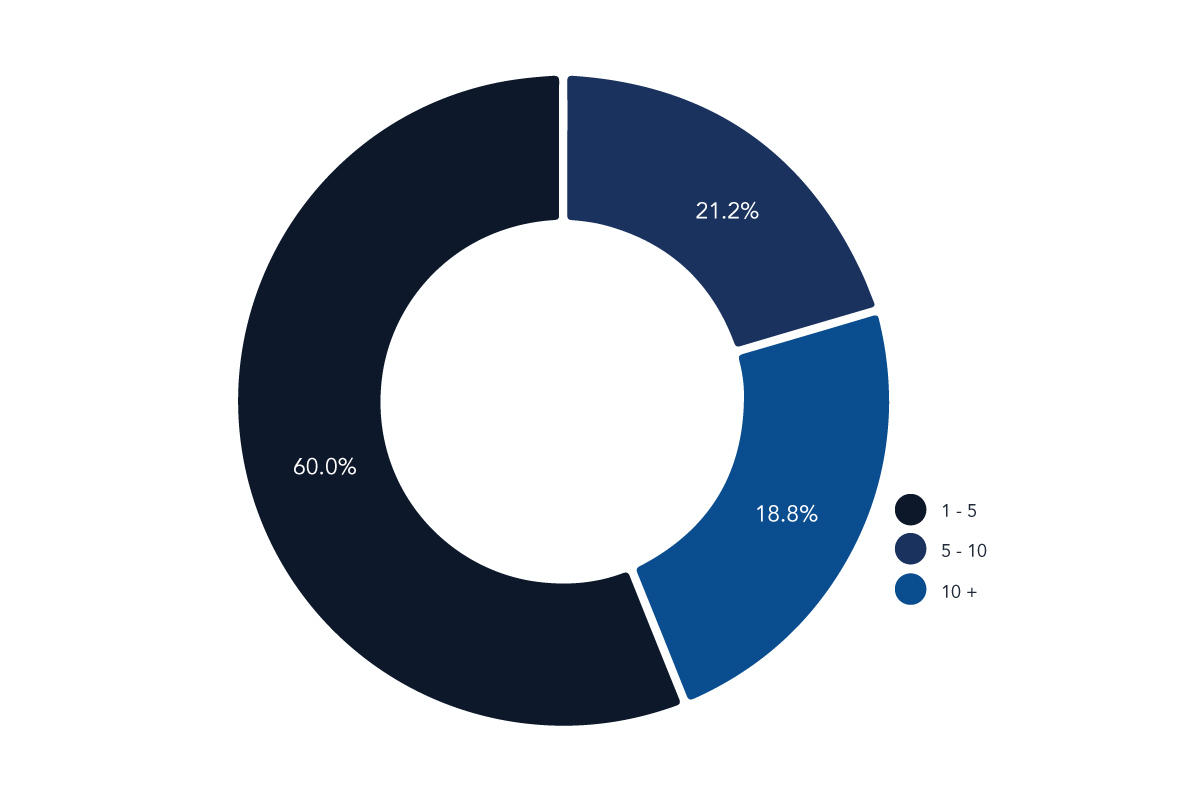

How many employees do you have in your business?

Businesses that have between 1 and 5 people working in them remain the mainstay of the wet leisure industry. Over the 5 years of the Wet Leisure Survey they have accounted for between 55% and 60% of the respondents.

This year that figure is 56%.

Looking at the other two segments over the 5-year period a picture does seem to emerge.

It appears to show that businesses were growing and putting on staff until the economic downturn of 2012. At that point many businesses were forced to downsize and they have only returned to growing staff numbers as the UK economy has slowly improved. This year the larger (10+ staff) businesses represent 23%, which is their highest figure since 2012.

If the number of staff is an indication of business growth, then the wet leisure industry does appear to be slowly returning back to health.

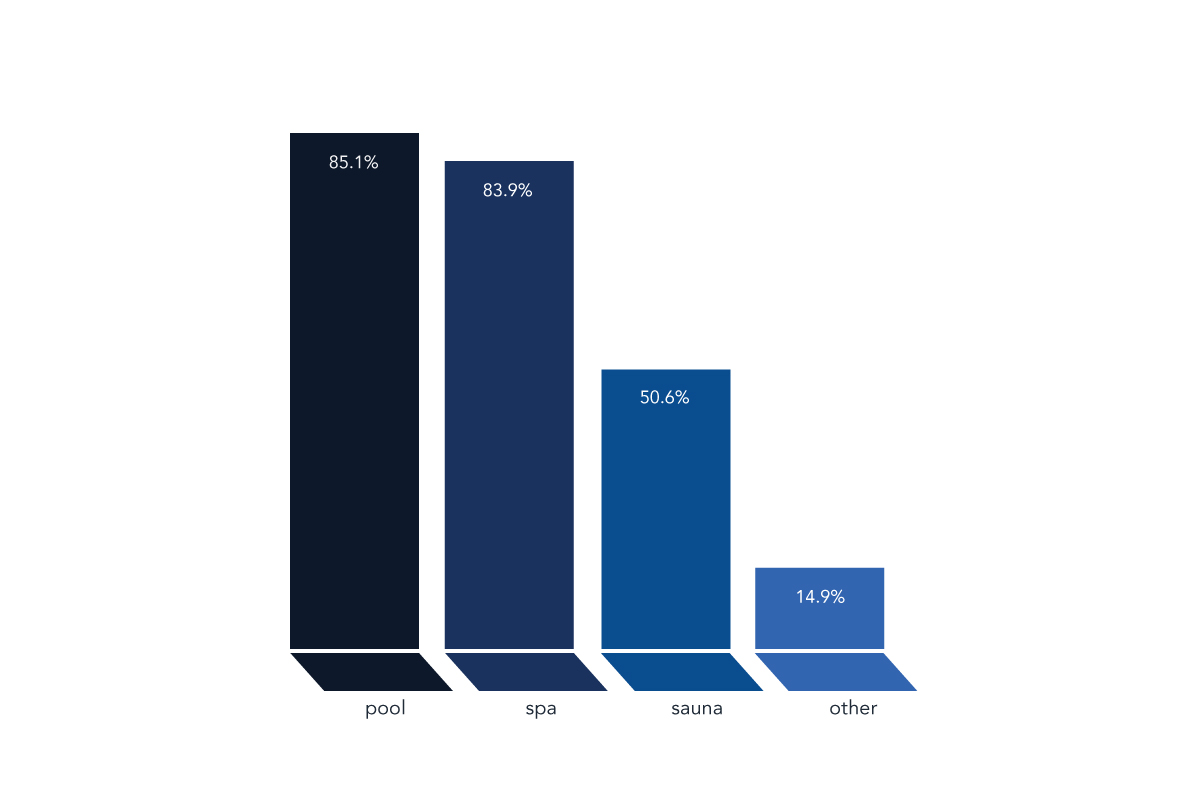

What sectors of the wet leisure industry do you serve?

2015 showed strong growth in the popularity of spas and hot tubs.

What might be driving that is impossible to tell from this survey, however, it does seem that hot tubs have been getting more and better coverage in the mainstream media recently.

Newspaper articles have talked about spas in regard to how lottery winners might spend their money, luxury items that people most aspire to and what you might expect to find at your perfect holiday cottage. That will certainly all have helped.

As they did last year, almost 50% of businesses that ticked ‘other’ clarified their response by saying that they were installing steam rooms and steam showers.

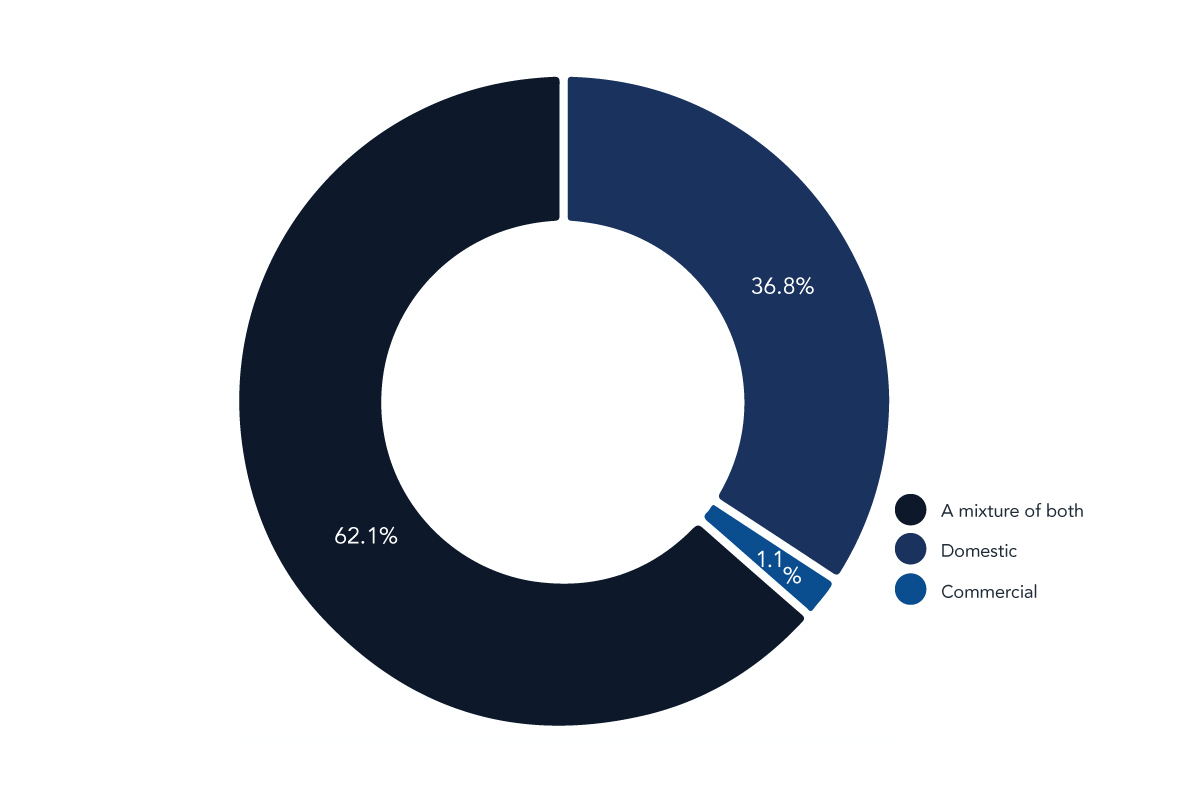

Are your customers and clients domestic, commercial or a mixture of both?  The number of businesses that work mainly on commercial projects has shrunk steadily over the last 5 years.

The number of businesses that work mainly on commercial projects has shrunk steadily over the last 5 years.

From 4.5% in 2011, we now see less than 1% of respondents describing their customer base as predominantly commercial.

Of course, commercial contracts are still extremely important to the wet leisure industry although they are now much more likely to come from hotels, health clubs and holiday rental properties than from local councils.

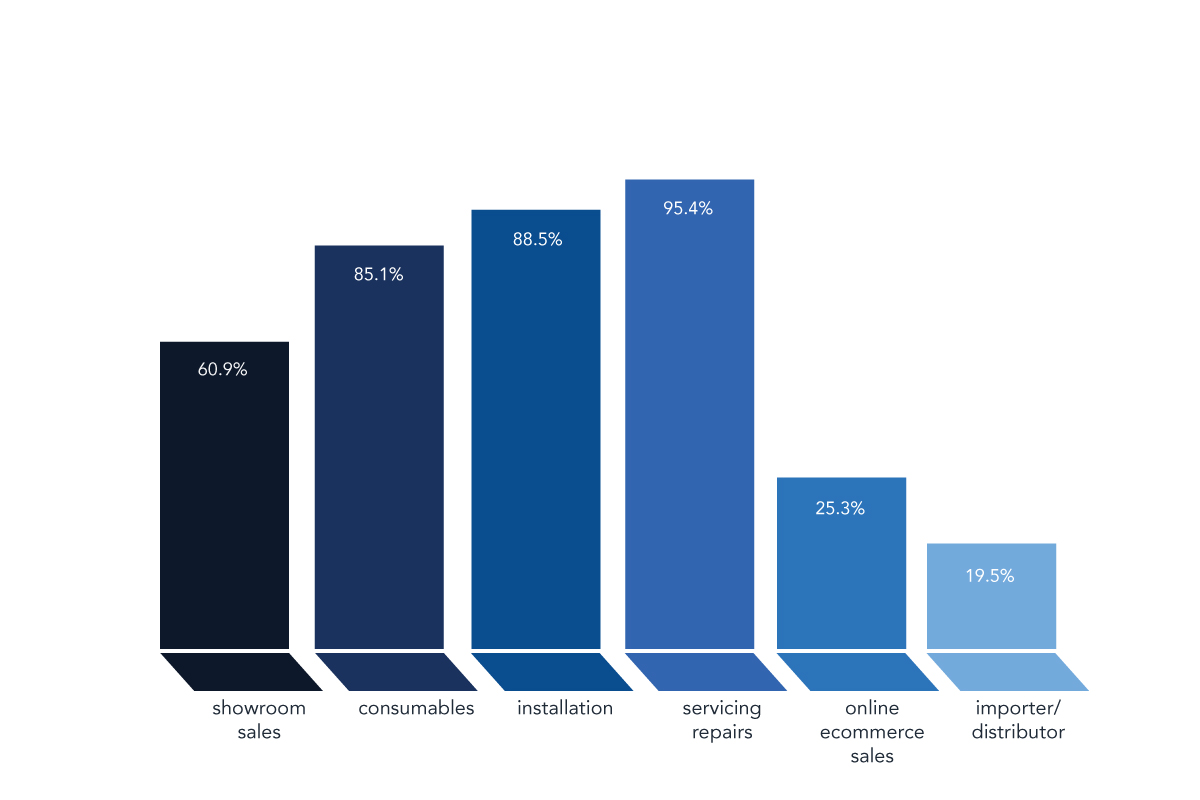

What are the services you offer your customers?

For the third year running, Servicing and Repairs has scored the highest when businesses are asked what services they offer their customers.

For the third year running, Servicing and Repairs has scored the highest when businesses are asked what services they offer their customers.

Reasons for this from the customer’s point of view might be that they are ‘cash rich and time poor’. It might be that installations are becoming more complicated or that people are becoming less practical. In part it might reflect growth in the hotel, leisure and holiday rental market.

There are strong reasons to promote this service from the businesses perspective. Servicing provides them with a regular income. It keeps them in touch with their clients so that they can sell retrofit products to upgrade existing pools and it ensures that they are top-of-mind as and when a new installation is looked for.

The responses to this question over the 5 years of the survey also show another trend. The number of respondents offering Online / E-commerce has shrunk steadily every year.

From 39.7% in 2011 to 27% in this year’s survey, doing business online has obviously proved to be a challenge.

As everyone is well aware, most online businesses compete on price. As customers become more and more adept at price comparison, online retailers are forced to shave their margins thinner and thinner.

At the same time, as the online market becomes increasingly competitive, the costs of digital marketing and website technology increase.

There will always be a sector of the wet leisure industry that trades online predominantly in consumables and spas, however we are likely to see that market become dominated by a smaller number of larger businesses.

“The pool industry is struggling where it tries to compete on price only. Internet based businesses will continue to struggle because their business model is flawed.”

So in broad terms the industry that these first few questions describes hasn’t changed significantly over the course of the last 5 years and that surely comes as no surprise.