Was 2022 a good year for the Wet Leisure Industry?

2022 was a year of contrasts. Quite often, extreme contrasts.

On the 19th July, Lincolnshire recorded a temperature of 40.3°C making it the hottest day on record and we all know that our industry thrives when the sun shines.

However, rainfall for the season was also well above average. The UK had 402.5mm of rain, which is 19% more than normal and although a warm summer tempts people out into their pools and spas, it is a dry one that really makes a difference to the business.

This year we had that interesting combination of flooding and a hosepipe ban. Neither is ideal for business. Even now, many local authorities are concerned with reservoir levels and are asking customers to be careful with water usage.

At the beginning of the year the UK economy was still adapting to the changes brought about by Covid and BREXIT when, in part due to the war in Ukraine, energy prices started to climb and, when the price cap was removed, skyrocket. By the end of the year the country was suffering from a cost of living crisis driven in particular by these spiralling energy costs. It quickly became clear that this would hit the wet leisure industry hard and so it has done.

However, there is one sector that still appears to be thriving. The rich are different to us. They have more money. The upper end of the wet leisure industry had a good year and they appear to be set to continue to do so.

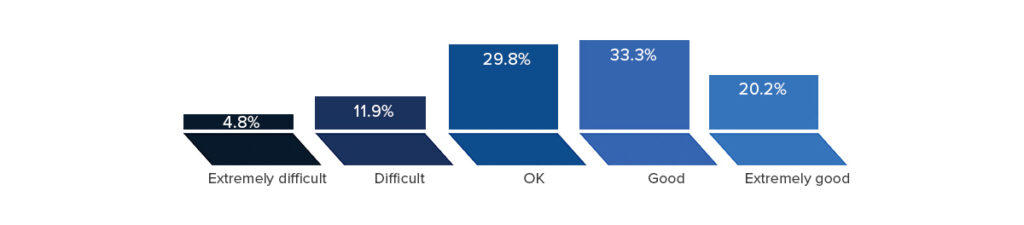

On the following scale, how did you find business conditions this year?

83% of respondents found 2022 to be OK or better in terms of business conditions. In contrast, in 2021, 92% of businesses described the year that way.

As we have already seen, 2022 started as another promising year but really did end up in the doldrums.

With inflation swallowing any pay rises and the threat of enormous energy bills landing on the mat, consumer confidence fell steadily and steeply throughout the year. People had deteriorating view of their personal financial situation and many just stopped spending money wherever they could.

Against such a background it is a tribute to the strength of our industry and the people working in it that so many businesses found 2022 as good a year as they did.

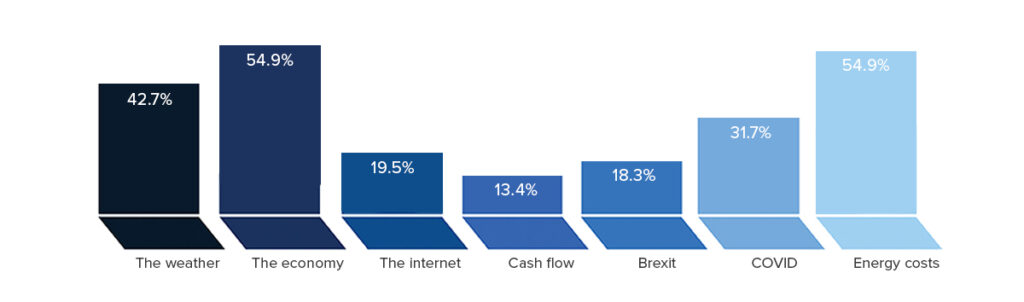

What would you say were the things that had the biggest influence on your business this year?

Last year, Covid scored 88% on this question. This year it scores 32%.

Last year BREXIT scored 33%. This year, it’s 19%.

It just goes to show, whatever crisis you think you are facing, the future has something new waiting around the corner to come along and overshadow it.

This is the first time Energy Costs has been an option on this list and it scores over 54%.

Of course, not all of the things that have influenced a business over the course of a year will fall under these neat headings and so we give respondents the opportunity to add their own comments.

“Still busy from Covid and the clientele have money so it hasn’t effected them.”

“Energy costs will become a factor but the past season was unaffected.”

“Energy increases at first had little impact, when Liz Truss announced the 2 year fix on energy costs, the market showed signs of recovery, however when that decision was reversed, that had a very negative impact on consumer demand for all electrical appliances which we are yet to see any signs of recovery.”

“Material supply plus on going increase in materials.”

“It was our busiest & most profitable year to date!”

“We knew there would be a post Covid correction on sales and that the exceptional highs of previous years was artificial but the slowdown was quicker and deeper than expected as a result of the war in Ukraine the knock on effects it has on the cost of living. Musical chairs for the position of Prime Minster haven’t helped much either.”

“Although there was good weather, which had a positive impact, we had a hose pipe ban which impacted pool and hot tub use. Drop in hot tub sales in the second half of the year due to energy cost concerns.”

“The internet selling at virtual cost is a huge headache, year on year.”

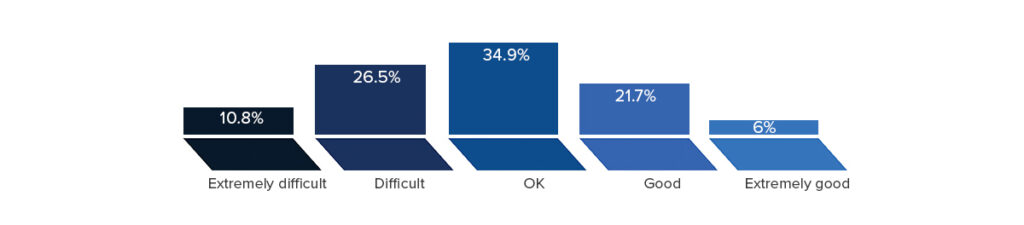

On the following scale, how do you expect conditions to be next year?

They say that as a nation we are all of us concerned for the future, anxious about what tomorrow has in store. It seems our industry feels that way too.

Spiralling energy costs are a given and where as they provide an opportunity for sustainable and energy saving products they will impact badly on the industry as a whole.

The climate crisis is likely to continue to bring us unusual weather events, such as hot, wet summers, flooding and hosepipe bans when what we are looking for is the idealised warm and sunny summers of our youth. (’76 for preference)

As foreign travel opens up again, the staycation may loose its popularity. Even if it doesn’t, there is some evidence to suggest that anyone who wants to buy a hot tub bought one last year. The problem they have now is that they can’t afford to turn it on.

BREXIT. Let’s not forget BREXIT. And Covid. There are roughly 2 million cases of Covid in the population.

“Economic and energy. Economic turbulence.”

“Lack of consumer confidence and high energy costs automatically reducing demand.”

“Customers becoming more aware of running/heating costs.”

“Availability of stock, cost of certain products.”

“Running costs, cheap product failure over new and quality products. Heating costs.”

“Rising cost of living, both in terms of increased costs to our business and decreased sales. Consumer confidence is low.”

“Energy bills, internet sales, shortage of skilled staff.”

“Without doubt, energy costs combined with a squeeze on the costs of living which erode consumers disposable income will present the biggest barrier to sales of hot tubs in 2023. As well as the reduction in demand, we have to battle the negative perception consumers have of hot tubs due to the flooding of poorly insulated hot tubs on the market during Covid that have created some horror stories on social media owners groups.”

“Consumers being unable to afford our goods and services.”

“Rising energy costs although the top end customers probably won’t be affected.”

“Having enough staff to undertake the work!”

“Top end products seem unaffected by the downturn which is good but the challenge is to maintain sales middle ground where volume is important.”

Just over 50% of respondents mentioned energy costs in their responses.