Was 2021 a good year for the Wet Leisure Industry?

The answer to that question is very much, ‘It depends…’

A number of factors were at play over the course of the year; some of them helped business growth and some hindered it.

Even the weather couldn’t be relied on to affect the country as a whole. The summer of 2021 was a season of contrasting fortunes across the UK, with the north and west of the UK experiencing a warmer, drier and sunnier season compared to average while parts of the south east have been duller and wetter than average.

Possibly due the impact of climate change, there were several notable weather events through the summer, including a new temperature record for Northern Ireland and Storm Evert which brought strong winds and heavy rain across England and Wales and extreme rainfall in the south east. A mixed bag.

Covid’s impact, particularly on the travel and tourism industry, once again appeared to drive demand for new pool, spa and swim spa installations while at the same time the global impact of the pandemic disrupted both manufacturing and the supply chain and often made these new orders hard to fulfil.

For the UK, supply chain issues were further complicated by BREXIT.

Growth in home improvements and construction increased demand for new build pools while test and trace and positive testing leading to isolation reduced the overstretched labour pool of skilled tradesmen still further making staff recruitment a major issue for many businesses.

How good any particular wet leisure business found conditions in 2021 was very much down to how they coped with these challenging and conflicting conditions.

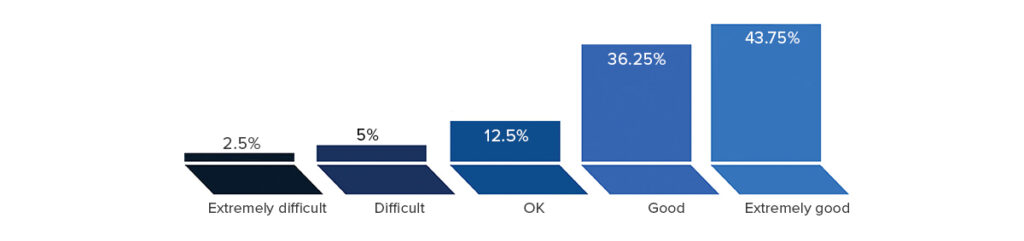

On the following scale, how did you find business conditions this year?

43% of respondents described the year as Extremely Good; the biggest proportion to do that since the survey began.

However, 7.5% reported a year that had been Difficult or Extremely Difficult.

The year certainly had its challenges. Perhaps business in 2021 could be characterised by looking at supply and demand. Customers had money that hadn’t been spent on holidays, and lockdowns focussed people’s thoughts on their homes and how to improve them plus heightened awareness of health and wellbeing. These things drove customer demand. BREXIT and the supply chain in general plus disruption in manufacturing made it harder to fulfil this demand.

79% of respondents came through the year having balanced those opposing conditions successfully but that outcome wasn’t always guaranteed.

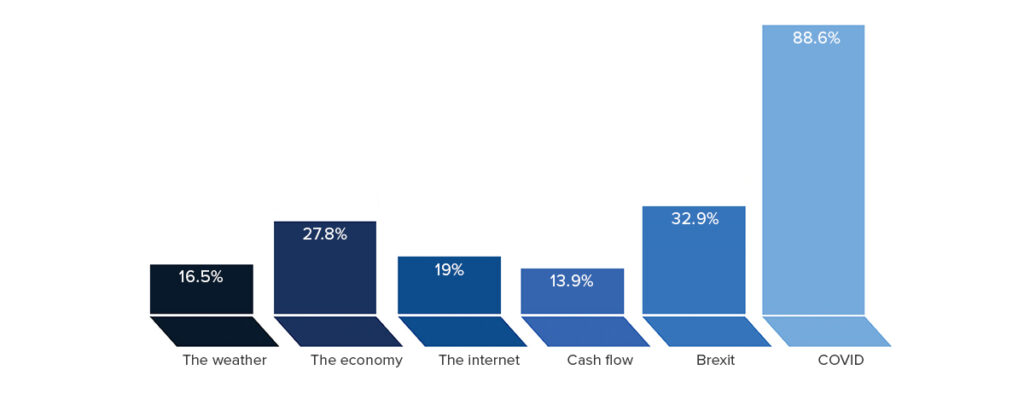

What would you say were the things that had the biggest influence on your business this year?

Last year, Covid scored 87% on this question. This year it scores 88%.

Last year BREXIT scored 5.5%. This year, it’s 33%.

Last year the effects of Covid across the economy rather disguised the impact of BREXIT but this year it was easier to see. With many manufacturers and suppliers to our industry being based in Europe, new regulations and restrictions had a significant impact on business.

It has taken a worldwide pandemic and the biggest upheaval in European politics for a generation to knock the weather off its top spot for this question, but knocked down to fifth place it is.

This is how some of the respondents described the situation in their own words.

“During the Covid pandemic business was very good as a result of people being on lockdown with money saved from limited social life and holidays. After 18months I feel most people are starting to feel the pinch now.”

“Whilst consumer demand has been record breaking, manufacturing output has been very poor meaning that we’ve not been able to match output with demand, which is frustrating. Moreover, supply chain delays have also created record numbers of cancelled orders from consumers getting frustrated with multiple delays.”

“Sales were excellent but Covid caused issues – mainly staff having to isolate.”

“The effects of Covid brought many challenges both from an operational aspect – needing to use additional PPE and have stricter precautions in place – and the knock-on effect of high spa sales plus a lack of part manufacturing and the eventual shortfall of parts that resulted.”

“The amount of items on backorder was staggering and spa owners struggled to understand why certain items were not available. Also we found that while showrooms were concentrating all efforts on new spa sales, aftercare was slipping and in some instances was non-existent.”

“Brexit. Due to the huge disruption associated with the import and export of goods caused by the haulage industry being totally unprepared and probably under informed together with a lack of drivers to get our goods supplied to us or delivered via carriers to customers.”

“Covid has had an awful effect on people’s lives but a very positive one on our industry as the nation became more in tune with home, health and wellness.”

“Covid has driven sales earlier in the year but the shipping crisis is curtailing it now.”

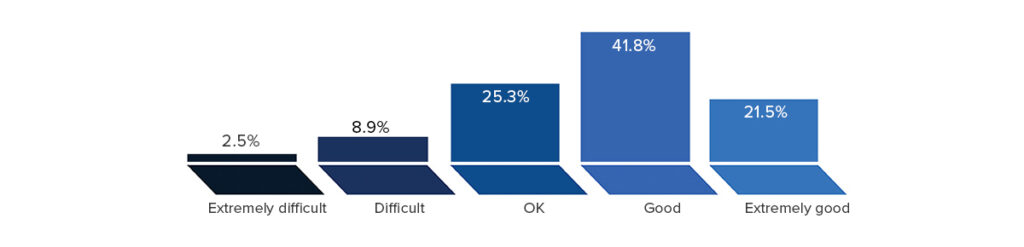

On the following scale, how do you expect conditions to be next year?

One of the constant trends across the lifetime of the Wet Leisure Industry Survey is that businesses expect next year to be pretty much like the year just gone.

This year’s survey shows quite a marked shift away from that. 43% reported having an Extremely Good year but only 20% expect next year to be same.

There are a number of reasons for that which have already been mentioned, particularly the continuing difficulties caused by BREXIT. There is also a feeling that anyone who wants a hot tub and can afford a hot tub probably has a hot tub by now. There certainly must be a degree of market saturation after two years of unprecedented sales.

From a broader perspective, there is increasing pressure to lift overseas travel restrictions and that is certain to have an impact on the popularity of the staycation.

On the other hand, a significant increase in the country’s stock of pools and spas must trickle down to an increase in demand for maintenance and repairs.

In fact, we asked people what they thought the biggest challenges their business would face next year would be?

These were some of the answers we received.

“Supply will likely get worse before it gets better in 2022, whilst consumer demand will drop year on year, so retailers will be squeezed at both ends making for a much more challenging year in 2022.”

“I think sales will be hard to come by, nearly everyone who was thinking of owning a hot tub in the next 3 years purchased one in the 18 months period.”

“Market saturation and new competitors.”

“Product availability and price. Constant price hikes are causing some dismay for both our clients, and us plus increasing labour costs due to shortages of good craftsmen.”

“We remain Covid ‘alert’ as we go forward. Zero cases in our teams so far and we want to keep it that way. Succession planning; bringing in the right people to maintain our business volume and modest growth.”

“Everything returning to normality; e.g. people going on holidays again and not spending as much at home and supply chain issues continuing to be a problem.”

“Supply chain issues. Long lead times and shortages. High raw material costs. High RRP’S. Impatient customers.”

“Brexit – Importing goods has become difficult, expensive and unpredictable.”

“Amateurs coming into the business because of high demand.”

“Prices and availability of consumables and parts. Plus increased prices of new spas due to manufacturers having to pay increased prices for their parts and materials.”

“Consumer luxury spending diverted to overseas holidays and fuel prices inhibiting spa sales.”

As you can see, there are some quite specific concerns about the short-term future of our industry. The external threats of BREXIT and the supply chain are hard for businesses to do anything about that will mitigate those concerns.

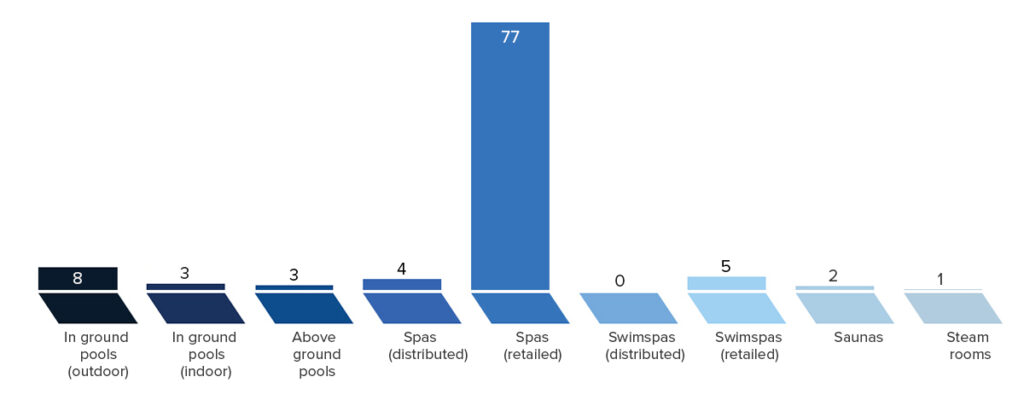

During 2021, how many of the following products did you sell?

It is important to bear in mind that the numbers of products sold are drawn solely from the survey respondents and are not overall industry sales figures.

The survey figures show outdoor in-ground pool numbers have shrunk slightly from 496 installations to 382; although that is still an extremely healthy number.

Spa sales are down to 3,248 from last year’s peak of 5,661.

There are many things that could go towards explaining the difference between the two figures not the least of which might be a difference in the businesses that responded to the survey. However one factor that is likely to be hugely significant is the weather. The summer of 2021, as we have already noted, was patchy across the country and with quite high rainfall. 2020 by contrast was one of the sunniest and driest summers the UK has enjoyed since records began.

Even in a year of BREXIT and Covid, the weather likes to demonstrate to us the influence it has over our industry.