What sort of businesses made up the survey sample?

The questions in this section are designed to show what sort of businesses answered the survey and they also give a good overall picture of the wet leisure industry.

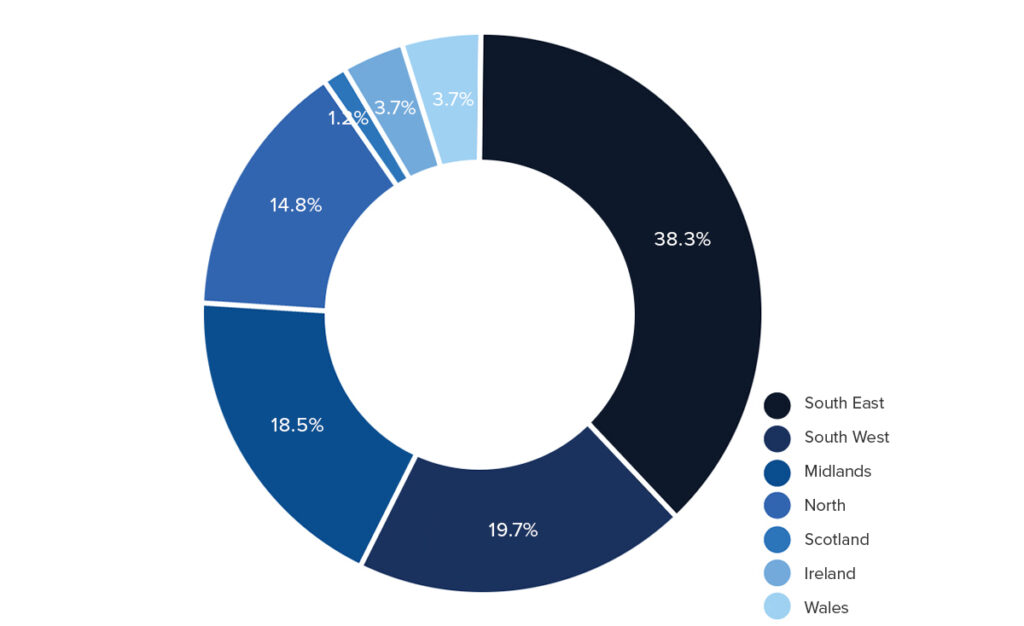

Which region of the UK does your business operate from?

The geographical spread of the Survey respondents across the UK has remained broadly the same since the Survey began in 2011. To a large extent, it simply reflects the relative economic importance of each of these regions.

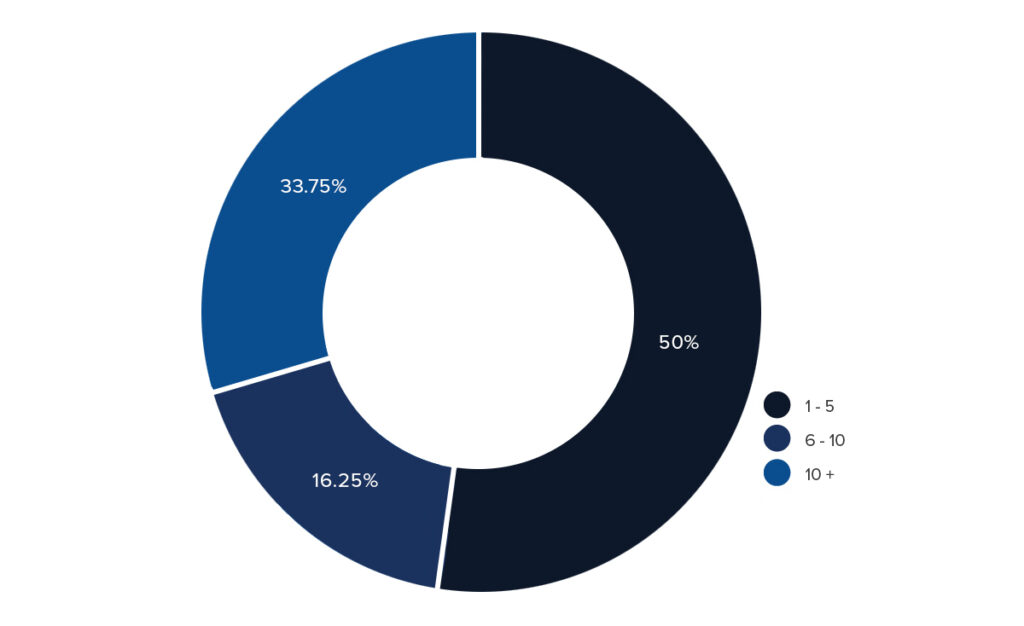

How many employees do you have in your business?

Here we can see a long term trend developing. At almost 35% of our survey sample, the number of businesses with ten or more employees is at its highest level since the survey began in 20XX

One obvious conclusion is that customer demand is generating enough work to keep those bigger businesses going. Certainly the pool sector has been busy this year and it seems that more bespoke and complicated installations combining spas, steam rooms and wet rooms are continuing to be popular.

Perhaps the more specialist skills involved in these sorts of installations drive businesses to have a broader employee base as opposed to one or two general tradespeople

The other side of this coin is the number of respondents who pointed to finding qualified staff as one of the biggest challenges they face. A challenge compounded by the boom in the building trade and an industry wide shortage of skilled tradesmen.

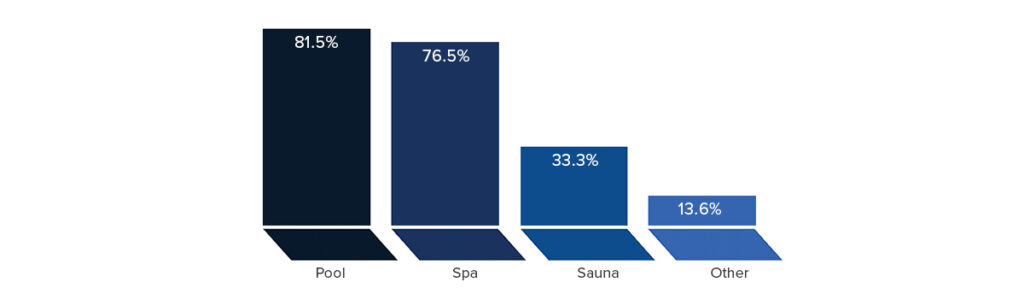

Which sectors of the wet leisure industry do you serve?

Pools, it seems, are in demand. Two years of Covid; two years of pools taking the top slot.

Staycations have led to home improvements and those improvements have led to the gold standard in that particular area, the home pool.

Over 80% of the respondents had been involved in the pool sector in 2021.

Other respondents cited projects from air handling to outdoor kitchens and equine hydrotherapy but steam showers and steam rooms were the most common additions to the list of the big four.

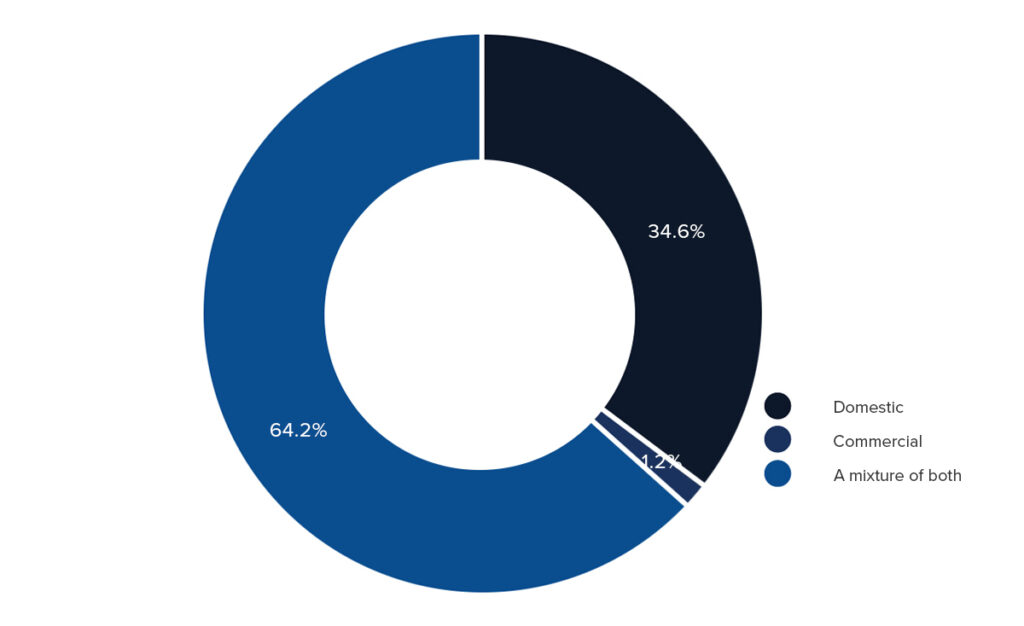

Are your customers and clients domestic, commercial or a mixture of both?

Over the last five years the purely domestic sector of the industry has slowly shrunk and this year it stands at 35%.

Of course this change has been brought about by businesses taking on both domestic and commercial projects as the lines between the two become more and more blurred.

Pools, saunas and spas in health clubs and spa hotels increasingly have the attention to detail and bespoke design that you might find in a top-end domestic installation while those domestic installations are using the very latest technology to minimise maintenance and improve the bather experience.

In the holiday accommodation sector, a spa or hot tub is almost a given t and lodge and cottage owners are increasingly turning to heat pumps to keep the energy costs down.

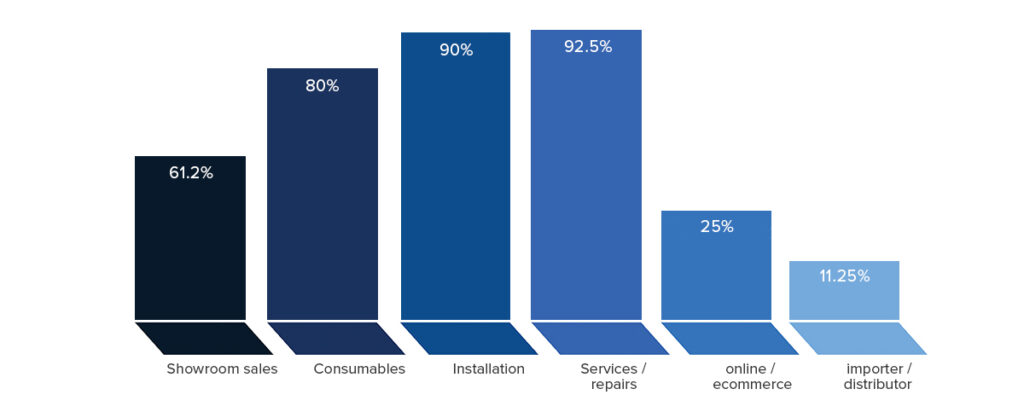

What are the services that you offer your customers?

The relative rankings of these six services have remained the same since the survey began.

Although it doesn’t show in these results there is certainly reason to think that lockdowns and social distancing brought about by the pandemic influenced how much these services were used by customers.

Some respondents have said that showroom traffic has reduced massively over the last year and that Internet sales have increased. This is in keeping with retail and other business across the country as a whole but it is interesting to see how it impacts our industry.

Although the Internet is often vilified, over the two years of the pandemic it has allowed wet leisure businesses to stay in touch with their customers and sell them everything from chemicals to spas and saunas.

In summary

The respondents to this year’s survey show us an industry that has remained broadly similar from a geographic point of view but has seen two distinct new trends developing. Larger businesses, with staff of ten or more, are more prevalent and there has been sustained growth in the pool sector.

The Wet Leisure Industry operates within the UK economy as a whole and across the country there has been growth in the construction industry and the service industry that has driven economic growth up to pre-Covid levels.