People who were forced to stay at home had furlough income to spend and enjoyed exceptional weather over the spring and summer; schools were closed, children were at home.

“With more people at home the pool became very important, mostly to keep the kids out of the house.”

It was the sunniest May on record with 266 hours of sunshine and the hottest August in 17 years.

“If the sun shines then existing customers are more willing to invest in their pools. This year wasn’t blistering hot, but good enough for existing owners to enjoy their pools and new people to consider owning a pool.”

Travel restrictions meant that people found an alternative to holidaying abroad. 2020 was the year of the staycation. The spa and hot tub sector in particular was well placed to make the most of the opportunities. Above ground pools saw their best year ever recorded by the Wet Leisure Survey.

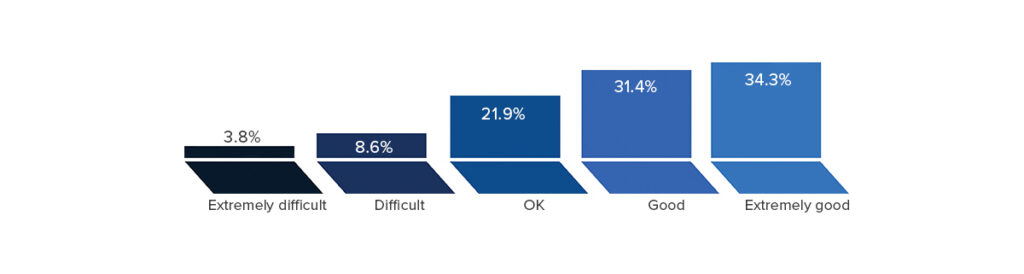

On the following scale, how did you find business conditions this year?

In 2020 over 34% of respondents reported having an Extremely Good business year; a significant increase over 2019 when only 12% of respondents reported their year as being Extremely Good.

In 2020 over 34% of respondents reported having an Extremely Good business year; a significant increase over 2019 when only 12% of respondents reported their year as being Extremely Good.

“Traditionally solar powered, our business was turbo charged by the effect of a period of exceptionally good weather coinciding with a nation on furlough during lockdown.”

At its core, the wet leisure industry offers health and relaxation to our customers and there has perhaps never been a time when those qualities have been more valued.

“As people have worked from home and have been more restricted in travel, they have looked to invest in wet leisure. Enquiries and interest has never been so positive.”

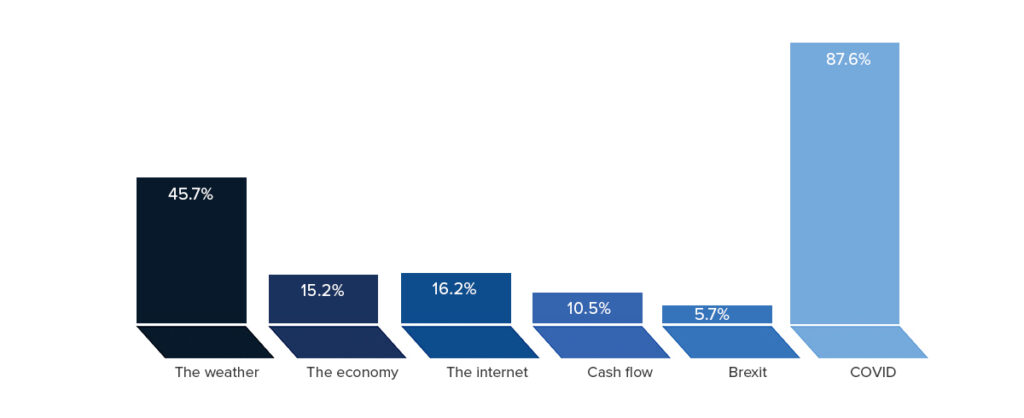

What would you say were the things that had the biggest influence on your business this year?

The implications and repercussions of Brexit are still likely to have the largest impact on the UK economy for many years to come and yet the pandemic is seen as having roughly fifteen times the effect on businesses this year.

The implications and repercussions of Brexit are still likely to have the largest impact on the UK economy for many years to come and yet the pandemic is seen as having roughly fifteen times the effect on businesses this year.

“Although sales were good, lockdown created its own problems. Having to isolate while waiting for test results Suppliers closing. Staff on furlough. Basically we dealt with 4 x normal sales with just 30% of the team.”

Certainly COVID-19 is a clear and present danger whereas the effects of Brexit are only now becoming visible as trade occurs across our borders, both imports and exports. Over the course of these surveys, the weather has generally been seen to have the biggest influence on any given year and, as we have already noted, it has had a massive effect again. The weather combined with the lockdowns powered the strong growth in 2020. If we had suffered from a dismal summer the picture would have been very different.

“People being furloughed and the great weather meant the pools have been used considerably more than I’ve know in the past 12 years. When Internet based companies run out of the basics, people actually stared to call and use non internet pool suppliers and hopefully found we are competitive with internet firms. Hope this trend continues.”

And then we come to the Internet. In most years, the Internet is seen as the enemy, undercutting price and forcing dealers to shred their margins. The comments section usually has more than one mention of ‘cheap Chinese imports’. This year produced an intriguing insight on those very imports.

“They are reducing lead-times so dealers can secure orders. China is eating into its lead-times so ‘not bothered’ buyers will take that route. That said I note China pricing is increasing fast.”

In 2020 however, at just 16%, the Internet had just half the influence of previous years and not all of the comments were negative.

“Because of COVID-19, Internet sales were up by approx. 400%, while retail was all but lost because our shop was shut. So while margins were down, turnover increase more than compensated.”

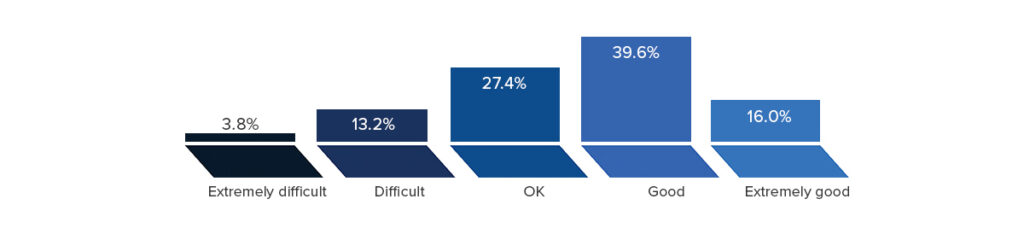

On the following scale, how do you expect conditions to be next year?

Each and every survey over the last ten years has shown that the industry expects next year to be pretty much the same as the one that has gone before it. The graphs that show business conditions for one year and business expectations of the following year are often well nigh identical.

Each and every survey over the last ten years has shown that the industry expects next year to be pretty much the same as the one that has gone before it. The graphs that show business conditions for one year and business expectations of the following year are often well nigh identical.

“Last year’s weather was good so new pool sales are good this year!”

This year’s survey however has a marked difference. 34% of respondents experienced an Extremely Good year in 2020 but only 16% expect that result to be repeated in the coming year. The unique combination of a summer heat wave and furloughed workers is unlikely to be repeated. As noted previously, the effects and business implications of Brexit are yet to make themselves clear but changes in import, and export, tariffs will certainly have a serious impact on the wet leisure industry. Where will we be in regards to COVID-19 is equally impossible to predict. Across the board, the future is uncertain, and uncertainty is bad for business.

“There is a general sense of uncertainty. Much like during a recession.”

“How will Brexit and COVID-19 restrictions upset procurement and site-works?’

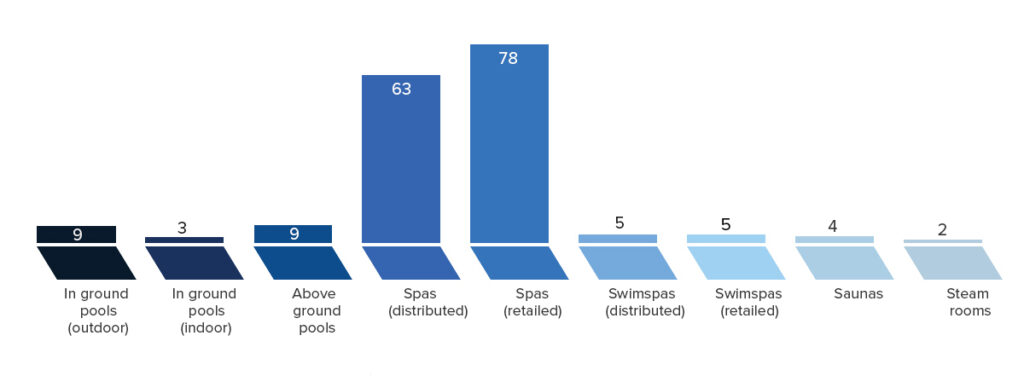

During 2019, how many of the following products did you sell?

It is important to bear in mind that the numbers of products sold are drawn solely from the survey respondents and are not overall industry sales figures. The survey figures show outdoor in-ground pools grow from 132 last year to 496 installations. The number of spa sales the survey reports also supports the phenomena of a hot tub summer boom. Last year the survey recorded 4,430 retail sales in this sector – which was in itself a bumper year – whereas this year’s survey saw that number increase to 5,661. When it comes to above ground pools, a recent BSPF members report suggested that there had been a 400 to 500% increase.

It is important to bear in mind that the numbers of products sold are drawn solely from the survey respondents and are not overall industry sales figures. The survey figures show outdoor in-ground pools grow from 132 last year to 496 installations. The number of spa sales the survey reports also supports the phenomena of a hot tub summer boom. Last year the survey recorded 4,430 retail sales in this sector – which was in itself a bumper year – whereas this year’s survey saw that number increase to 5,661. When it comes to above ground pools, a recent BSPF members report suggested that there had been a 400 to 500% increase.