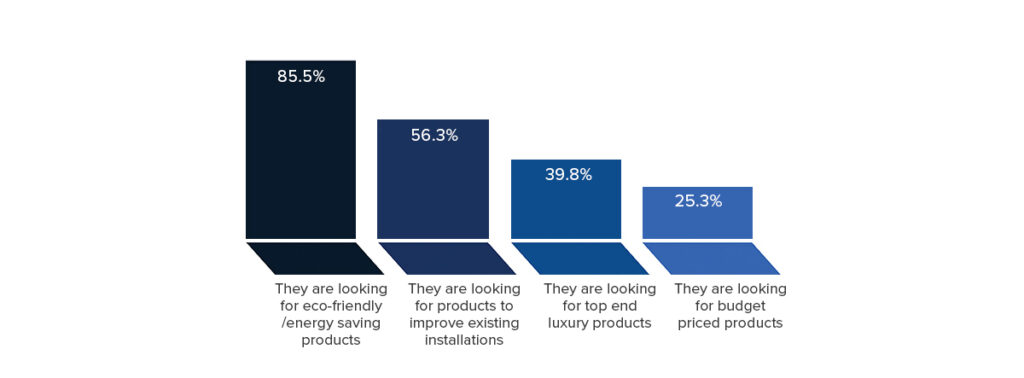

Which of these market trends are your customers following?

It’s no surprise to find that energy saving products dominate this chart this year.

Many of those products will be retrofit and might be either budget or top end.

“With sky rocketing costs, energy efficiency is a hot topic and we work hard on providing innovative solutions to the reduction of heating

and running costs for the consumer.”

Customers might be motivated by wanting to save money or save the planet but the demand for energy saving products is high and seems likely to grow, Energy saving is set to become the hot topic in the wet leisure industry for years to come.

Spas and hot tubs.

In terms of sales, spas and hot tubs are where the volume is in the wet leisure market.

The hot dry summer of 2020 combined with the travel restrictions brought about by Covid and the unspent cash from furloughed workers and un-taken overseas holidays brought spa and hot tub sales to their absolute peak. It was never likely that these conditions would repeat themselves and, indeed, they haven’t. Spa sales have been in decline ever since.

From a reported high in the Wet leisure Industry Survey 2020 of 5,661 units this year’s survey records just 1,498.

Market saturation and wetter summers have had a negative impact on hot tub sales but it must surely be spiralling energy costs that are killing sales now and it seems unlikely that the price of energy is going to come down significantly in the near future. In fact, it may well get worse.

Hot tubs remain highly popular in the leisure market with holiday parks and holiday rentals seeing the hot tub as a must have feature. Now we must just find a way for park owners and cottage letters to be able to afford to let their guests run the spas and enjoy them.

“The entry and mid market of the hot tub industry has completely collapsed, but the high end, well built hot tubs and swimspas are remaining consistent with previous years as consumers are now finally asking the right questions when looking at investing into the hot tub or swimspa market.”

Swimming pools.

We have seen significant growth in all areas of pool construction this year, from above ground pools to indoor and basement pools, swimming pools are the success story of the year so lets take a look at the businesses that install high numbers of pools for their clients.

Firstly, 50% of these pool specialists operate in the South East and almost 70% of them employ 10 or more staff.

50% of their clients are domestic, the rest being a mix of commercial and domestic. They concentrate on installation doing far less service and repair work than the survey average. They found 2022 Good or Extremely Good in terms of business. The general state of the economy has affected them far more than BREXIT, Covid or even Energy Costs.

Most of their business is at the top end of the market and their marketing efforts are almost purely digital.

More than half their jobs are new builds.

Even in this more affluent sector of the market, energy saving products and technologies are highly saught after.

Sauna and steam.

The respondents who have sauna and steam businesses that are performing well above the survey average are divided equally between the South East and the South West. They all employ ten or more staff. They all work with a mixture of both domestic and commercial clients.

For those businesses that specialised in sauna and steam, 2022 was a very good year for business. They appear to have escaped the impact of Covid, BREXIT and Energy Costs but I’m sorry to say, they don’t explain how.

They do half of their business at the top end of the market.

They mostly use social media and their website for marketing – plus word of mouth, of course.

And they are extremely confident about next year.

What sort of business shows most confidence in the future?

Less than 10% of the survey respondents expect next year to be an Extremely Good year for business.

It’s interesting to look at what sets them apart rom the rest of the respondents.

These, most confident, businesses are:

- Based in the South East or South West.

- None of them have a purely domestic customer base. In fact they do more than the average amount of commercial work.

- According to their responses, they claim to have been completely unaffected by BREXIT, Covid or Energy Costs.

- They installed a lot of pools and saunas and hardly any spas.

- 80% of their business was neither budget nor top end but in the middle of the market.

- They have seen enormous growth in sauna and steam.

What sort of business shows least confidence in the future?

Slightly more than 10% of the survey respondents expect next year to be an Extremely Difficult year for business.

If we look at what sets them apart rom the rest of the respondents we see businesses that are…

- Based in the Midlands or the South West.

- Smaller businesses in terms of staff numbers.

- Predominantly they are in the spa and hot tub sector.

- Mostly domestic customers.

- Their businesses have already been hit hard by rising energy costs.

Breakdown by region:

South East

37% of respondents operate in the South East.

This year, these businesses are a little smaller than the survey norm.

They are active in the pool sector and strong on service and repairs.

87% of them felt the year was ‘OK’ or better. They installed a lot of pools and a lot of spas. However they are sceptical as to how business conditions will shape up next year.

South West.

25% of respondents operate in the South West.

There are more smaller businesses in the South West with 57% of respondents employing 5 staff or less although this is a decrease on the 2021 figure of 65%.

A big proportion of the survey’s above ground pools are installed in the South West and well over half of those jobs are top end. Hot tub sales have fallen this year.

Sauna and steam are a growing sector for many of the businesses in the region.

Midlands.

22% of respondents operate in the Midlands.

Spas and hot tubs tend to dominate the market in this region. As such, energy costs have had a big influence on business and lowered performance this year and business expectations for next year

North.

10% of respondents operate in the North.

Businesses in the North tend to be smaller than the Survey average with over 80% employing less than 10 people.

Hot tub sales have always been high in the North but this year has shown growth in pools and saunas as well.

Energy cost increases hit the North hard and respondents expect business to be difficult next year.

Scotland.

Barely 1% of the survey responses are from businesses operating in Scotland.

It would be wrong to attempt to draw any conclusions or insights from such a small sample. We would like to thank the businesses in the region that did respond

Ireland.

There were no responses from Ireland this year.

Wales.

Almost 5% of the survey respondents operate in Wales.

Barely 1% of the survey responses are from businesses operating in Wales.

It would be wrong to attempt to draw any conclusions or insights from such a small sample. We would like to thank the businesses in the region that did respond.

In conclusion.

World events have had an influence on our industry that has been greater and more rapid than any that have come before.

The wet leisure industry is changing and it is clear to see the world events that have changed it. We can see cause and effect quite clearly. Although many of these changes are challenging, the fact that we can see what has caused them allows us to make better business decisions in the ways that we choose to react to them.

For instance, The energy crisis has been building up over the past year, as increased demand during the post-Covid reopening of economies coincided with Russia’s invasion of Ukraine and a subsequent squeeze on gas supplies into Europe. Consequently, a steep rise in the wholesale price of gas has driven up energy costs.

By looking at the causes, we can form an opinion on the scale of the energy crisis next year and how it will affect business. Are there sectors of the industry to move out of? Are there technologies and products to focus on?