Who took the survey?

Of course, the answer to that is that we don’t know. All the responses to the Wet Leisure Survey are anonymous.

What we do have are half a dozen questions that begin the survey that allow us to get a picture of what sort of businesses responded. Where in the UK they are based, what sort of services do they offer and how big are they.

This gives us a picture of the survey sample and a good idea of the state of the industry. These first questions provide a context for the rest of the survey.

2022 feels as if it needs a little bit more than that. It feels as if it needs a broader context. A context for the whole industry to be seen in.

Every year there are things that affect the wet leisure industry and affect the rest of the country and the economy too. We will usually mention those things to put the survey results in context. Looking back, 2022 was an exceptional year. There were things that influenced how our industry performed that were truly global events but often had a particular impact on the world of pools, spas and saunas.

As we go through the first six questions, we will examine just how those events moulded the business performance of our industry.

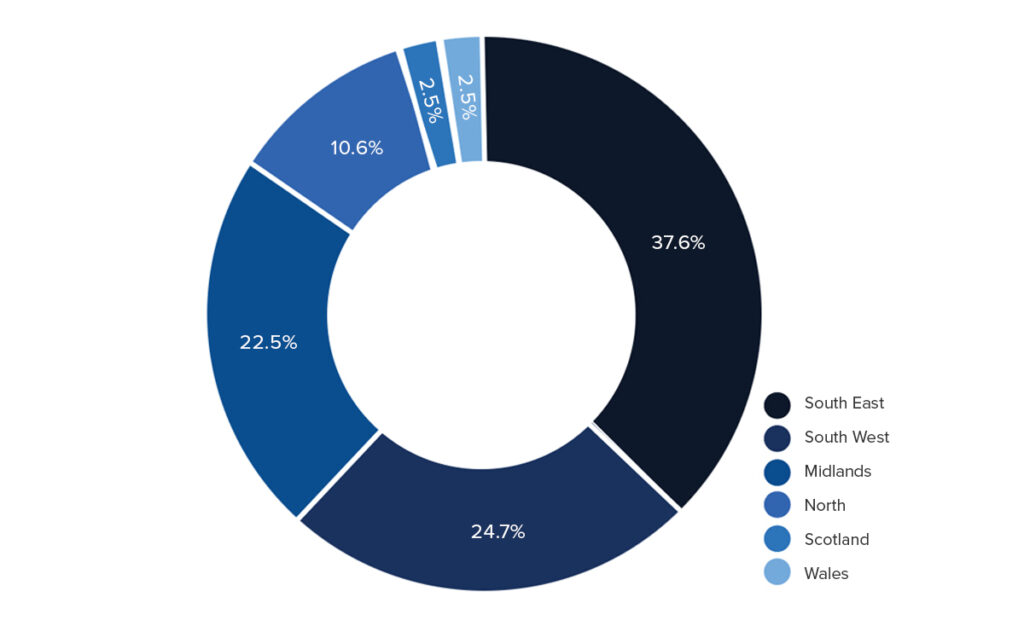

Which region of the UK does your business operate from?

We give businesses seven regions to choose from and at first glance the relative number of businesses operating in each area seems as if it simply reflects the economic strength of each of those areas, but that isn’t quite the way it is.

Geographically, London is the smallest region on the UK map but in 2022 Greater London grew more – in economic terms – than anywhere else in the UK. London grew by 14.4% over the course of the year.

The survey sees London as simply part of the South East but the likelihood is that business conditions in London are different to anywhere else in the UK; driven by salaries and income, driven by property prices, driven by the affluence of the capitol. In next year’s survey, London will be seen as a separate region.

The next anomaly is Scotland.

Scotland is a prosperous region with 12.8% growth in 2022 and yet less than 3% of respondents come from north of the border.

We know that there are some exceptional pools and spas in Scotland so perhaps this is more about a Scottish reluctance to participate in surveys.

And then we have the South West.

The economic data puts the Midlands and the North above the South West but the survey responses rank Cornwall, Devon and Somerset as the second largest region after the South East. Perhaps this is in part driven by the strength of the tourism industry in the region driving sales of pools and spas.

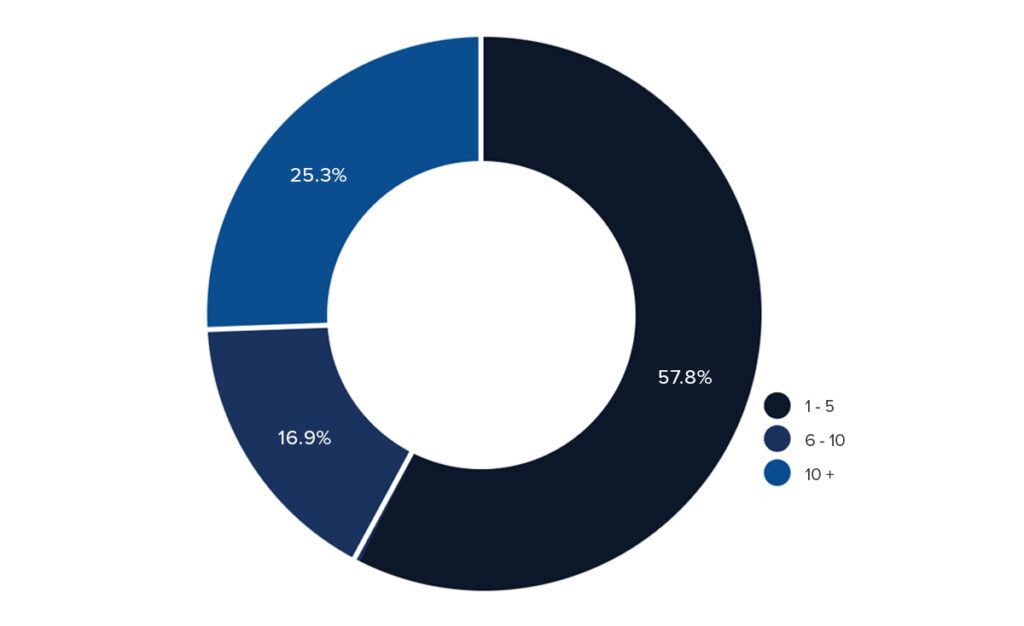

How many employees do you have in your business?

Most wet leisure businesses would be classified as SMEs. That is, they are Small to Medium Enterprises and as such employ less than 50 staff.

There are some interesting statistics if you look at the government research and statistics on smaller businesses in general in the UK.

- 99.21% of the total UK business population are small businesses with less than 50 employees.

- The average turnover of a small business in the UK is £286,482

- There are 5.3 million micro businesses in the UK with less than 10 employees accounting for 95% of all businesses.

- The average turnover of a micro business is £176,016.

Looking at the survey this year we see the first reversal of a long-term trend. Up until this year the number of businesses with ten or more employees had been growing steadily since the survey began in 2011. This year those larger businesses dropped back from 35% to 25%.

Sadly, it seems that the most likely cause of that is that businesses have been laying staff off to cut their overheads during difficult times.

Last year a significant number of respondents pointed to a lack of skilled staff as one of the biggest challenges they faced. This year there are only a couple of such responses.

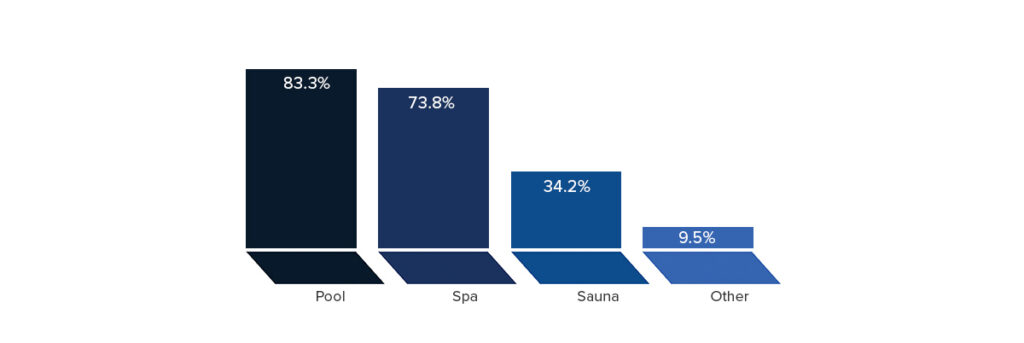

Which sectors of the wet leisure industry do you serve?

The third consecutive year of pools taking the top slot in this list.

The pandemic led to travel restrictions led to staycations led to people spending more money on home improvements. For the right property in the right area adding a pool to your home, either outdoor or indoor, remains the ultimate glamorous feature that can also add value to the house

There’s an estimated 210,000 private swimming pools in the UK with over two thousand more being built every year. As the top end of the market remains buoyant, then top end pools are being installed in properties up and down the country. As the country’s stock of pools rises, so does the amount of money being spent on chemicals, maintenance and servicing. Growth in one sector of the industry powers growth in another.

Respondents also reported being involved in equine and canine hydrotherapy projects and, of course, sauna and steam rooms.

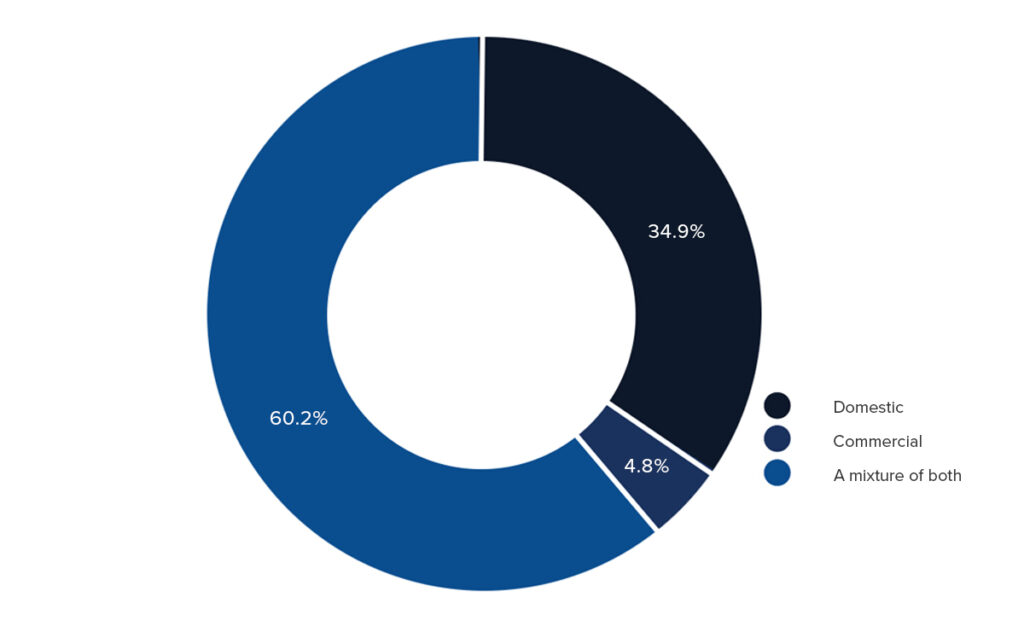

Are your customers and clients domestic, commercial or a mixture of both?

The purely domestic sector continues to shrink; this year just by one percent from 35% to 34%.

There has been growth in the commercial sector that has been driven by the health, leisure and tourism industry where pools spas and saunas are becoming more and more prevalent.

By contrast the last few years have hit public and council owned facilities hard. Swimmers across the UK have lost access to more than 60 public pools in the last three years. A lack of staff, rising energy costs and chemical shortages have created problems for public pools staying open that simply couldn’t be overcome.

Following Covid, there had been signs that some pools might open again but the spiralling cost of energy made those closures more likely to become permanent.

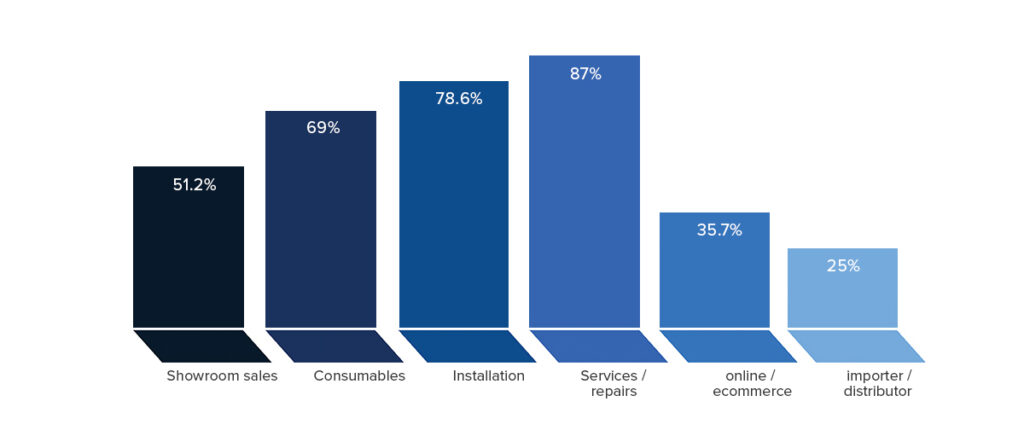

What are the services that you offer your customers?

Services and repairs stand head and shoulders above the rest at 87% and, as we previously noted, as the UK’s stock of pools increases, this business looks as if it can only prosper.

However, the pandemic and following that, the rise in the cost of living, has renewed Britain’s love affair with DIY. This isn’t to suggest that people will be building their own pools, but people may well be more likely to do their own pool maintenance and water treatment.

They might reconsider whether that regular maintenance contract is strictly necessary.

People will be looking to save money and water treatment and dosing technologies may look increasingly attractive when compared to the cost of a maintenance contract, particularly if it has become more commonly acceptable to be doing your own work.

The pandemic has had another influence on the responses to this question and this is one that has already taken place.

Online and e-commerce has grown to be a service that over 36% of respondents offer. As you will be well aware, this isn’t a trend restricted to our industry. In 2022, the UK was expected to have nearly 60 million e-commerce users leaving only a tiny minority of the population as non-digital buyers. As such, e-commerce has undeniably become the norm for shoppers everywhere in the UK. People may not be buying many indoor pools or a bespoke saunas online but we can be sure that the e-commerce market for chemicals and consumables is booming.

Over the coming years, the UK e-commerce market is only expected to grow. Between 2021 and 2025, experts estimate that it will increase by more than 25% to a total market value of £260 billion.

The wet leisure industry will not be exempt from that trend.

There is another trend that it is to be hoped our industry will benefit from; an increase in spending on goods that increase pleasure, plus an emphasis on health and well-being. Combine that with the increased importance and focus on the home and we should be well placed for future growth.

In summary

The respondents to this year’s survey show us an industry that has remained broadly similar from a geographic point of view. As the economic power of the capital becomes greater and greater it may well be worth treating London as a separate region.

We have seen businesses with ten or more employees reduce in number for the first time since the survey began and there is a possibility that this is due to staff cutbacks in a challenging economy.

Council run and public pools are facing significant problems and many are closing however, the wet leisure industry is now, more than ever, an intrinsic part of the UK leisure industry with pools, hot tubs and saunas becoming an expected part of the hotel and holiday park experience.

Will the trends for self-build and DIY spill over into the pool service sector and make pool and spa owners more likely to tackle service and water management themselves?