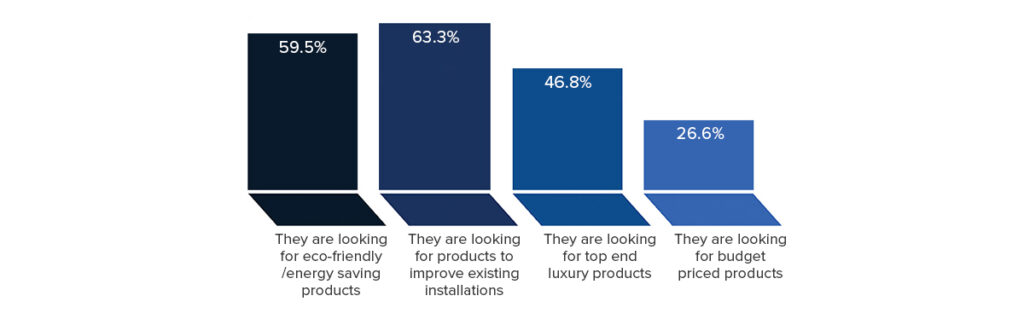

Which of these market trends are your customers following?

Retrofit products to improve an existing installation take the top spot amongst these consumer trends but eco-friendly and energy saving products are close behind.

Luxury products are almost twice as popular as their budget priced alternatives.

“Looking for mid range products but not afraid to spend more where needed.”

“Customers want the best possible product, but they want to pay as little as possible. We know that they can’t have both; so educating the public is key.”

“There is a continuing interest in technology that helps customers improve the cost of running their pools while also making ownership easier.

The ongoing interest in home health and wellness has also resulted in sauna business seeing further growth.”

Spas and hot tubs.

Spas are where the volume lies in wet leisure industry sales but the majority of hot tub businesses are involved in other sectors as well; 77% of them build pools and over 40% install saunas according to this year’s survey.

Hot tubs have proven to be an important draw card for the holiday industry and have increased in popularity in the domestic market. As the UK’s stock of spas and hot tubs increases both domestically and commercially, that drives growth in the business of maintenance and service.

The relatively short time line from interest to installation has meant that hot tub retailers have been able to respond quickly to the demand in part generated by Covid and make the most of the increase in business.

This year’s survey shows that all reported spa sales were either in the middle or top-end of the market. Cheap, inflatable spas are simply not appealing to people who are looking for something to soften the blow of not taking an overseas holiday. As we have seen elsewhere in the survey, people are looking for the best price, but they are looking for the best products as well.

From a marketing point of view, spas are the darlings of social media with Facebook recommendations being seen as one of the most effective forms of marketing in this sector.

60% of respondents reported a bumper year in spa sales this year but only 16% expected next year to be Extremely Good. Perhaps there is something in the possibility that the market is becoming saturated.

“Backlogs of some items due to factory closures during lockdown has been a problem, particularly with portable hot tubs.”

Swimming pools.

Pool businesses that have reported an Extremely Good year are one of the few groups to include businesses that only serve the commercial sector and one of the only groups to not show service and repairs as their most important sector of business. Presumably they concentrate on the construction and installation process.

The pool sector, both new-builds and refurbishments, is particularly strong in the South East.

When it comes to marketing, these pool businesses see word of mouth and their website as being more important than social media and Facebook.

“Word of mouth is always a winner as we use client’s pools to show to potential clients, so they know what to expect.”

Almost 80% of the pool builders have seen strong growth in their businesses in 2021 plus they are confident about the prospects for business next year with 24% expecting business conditions to be Extremely Good.

“There has been a massive demand for in ground pools that has sparked a growth in DIY Pool installations due to the fact that professional pool builders were booked up well in advance.”

“The market is very buoyant at present & we are already fully booked for new builds & refurbishments until Jan 2023.”

“DIY pool kits are in demand as we are unable to build new pools ourselves other than what we can cope with. So we sell them a DIY kit instead.”

Sauna, steam and swim spas.

The popularity of sauna and steam is spread relatively evenly across the UK’s regions with The South East and West, the Midlands and the North taking the lion’s share.

Businesses that sell sauna and steam installations are practically guaranteed over 90% – to work in the pool or spa sector as well.

48% of these businesses enjoyed an Extremely Good year in 2021 and 26% of them expect that to continue next year.

“Until recently, sauna has been one of our industries best kept secrets but we have seen a marked upturn in interest in a product line that is closely associated with spas and hot tubs and can be installed and enjoyed year round.”

Breakdown by region:

South East

38% of respondents operate in the South East.

They are more likely to employ 10 or more staff than the survey average and significantly more likely to be building and refurbishing pools. They faired better then most over the last year with almost 90% reporting a Good or Extremely Good year. The challenges they expect to face next year are rising prices and difficulty in finding enough trained staff.

South West.

20% of respondents operate in the South West.

There are more smaller businesses in the South West with 50% of respondents employing 5 staff or less although this is a decrease on last year’s figure of 65%.

Swimming pools are a very important sector in this region as is the provision of maintenance and service; probably due to demand from the tourism and holiday industry.

Midlands.

18% of respondents operate in the Midlands.

Bigger businesses are much more common in this region with 40% of respondents employing 10 people or more compared to the survey average of 30%.

Sauna has more importance in the market in the Midlands compared to the survey average and pools and spas less so.

50% of respondents enjoyed an Extremely Good year and almost 30% of them expect that to continue next year.

North.

15% of respondents operate in the North.

Last year, businesses in the North were smaller than the Survey average with over 80% employing less than 5 people. This year that figure has reduced to 40%. Yet more indication that wet leisure industry businesses are getting bigger in terms of staff numbers.

Hot tub sales have always been high in the North but this year has shown strong growth in the pool sector as well.

Scotland.

Barely 1% of the survey responses are from businesses operating in Scotland.

It would be wrong to attempt to draw any conclusions or insights from such a small sample.

Ireland.

Just under 4% of the survey respondents operate in Ireland.

They are smaller businesses – almost 70% employ less than 5 people –working across the pool, spa and sauna sectors. Sauna has traditionally been strong in Ireland and this year almost 70% of respondents from Ireland are offering sauna and steam installations.

Business was Extremely Good in Ireland in 2021 but respondents expect 2022 to be merely OK or Good.

Wales.

Almost 4% 5% of the survey respondents operate in Wales.

Businesses in Wales tend to be operating with fewer staff than the survey norm with 65% having 5 employees or less.

The respondents are mostly working in the spa sector. They enjoyed an extremely good year in 2021 but expect business to slacken up in 2022.