The questions in this section are designed to show what sort of businesses answered the survey and they also give a good overall picture of the wet leisure industry.

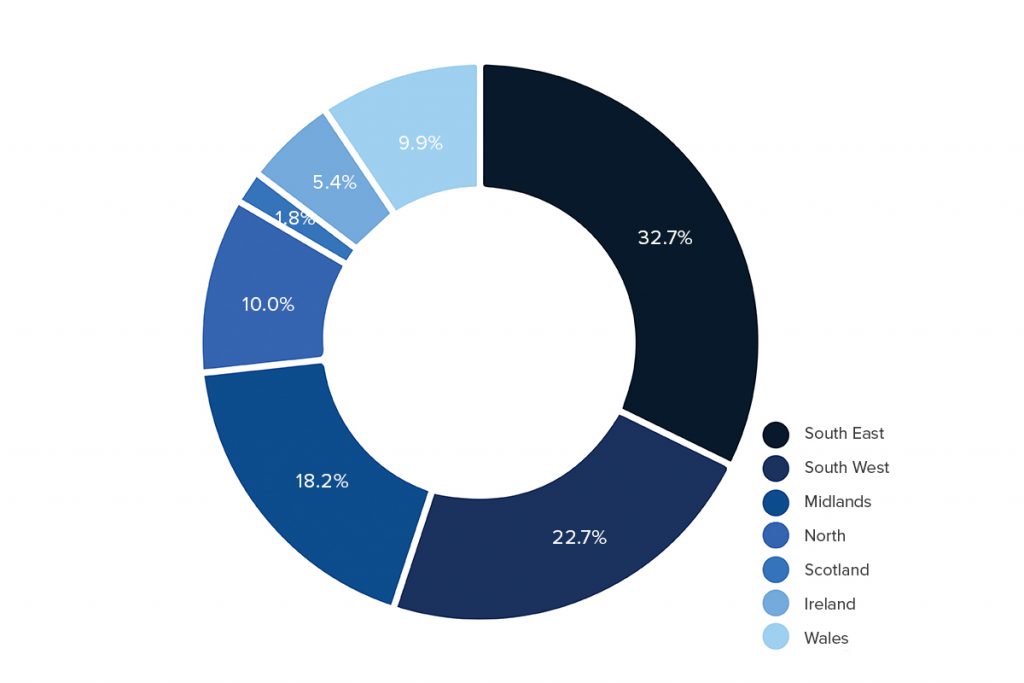

Which region of the UK does your business operate from?

No surprises here, in fact the order of size of each of these regions is almost identical to last year’s sample and has stayed the same since the first Survey in 2011.

When we look back at all the Survey results there are two trends that are worth noting.

The South East has always been the largest region but its relative size has diminished over time, from 40% of the 2011 sample to 34% of this year’s. This doesn’t necessarily point to less business being done in the South East; rather it can be an indicator of the growth in the other areas.

The North in particular has shown consistent growth although this year’s figures show that to have fallen back a little.

This year, Wales has grown from a steady 5% of the sample over the years to 10% of 2018 responses.

We will examine the regions in greater depth later in the report.

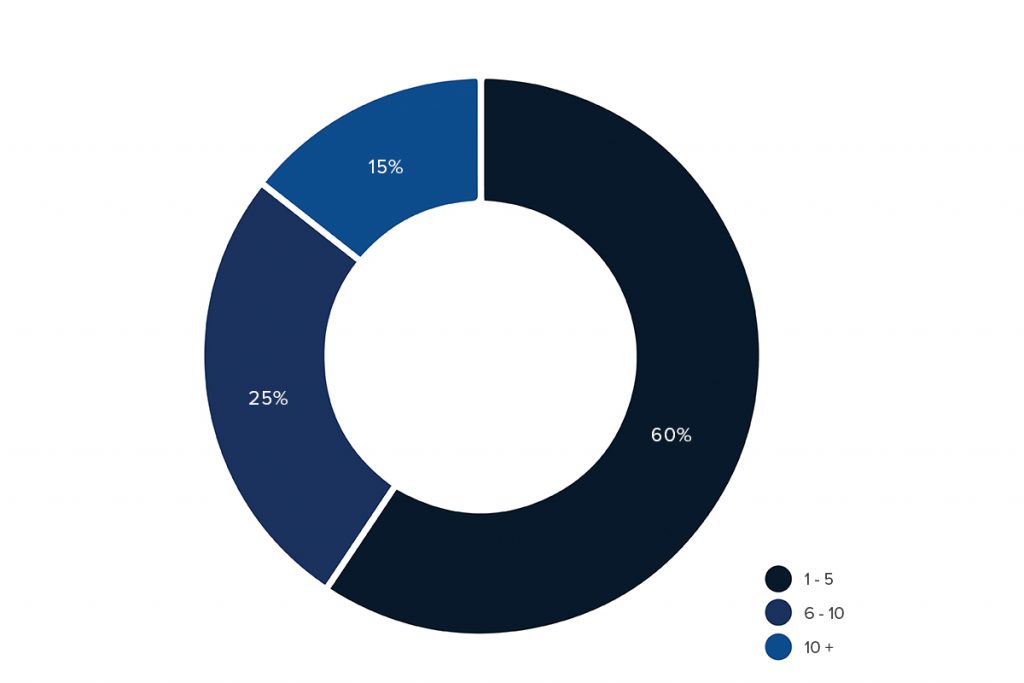

How many employees do you have in your business?

The wet leisure industry is predominantly made up of smaller businesses with between 1 and 5 employees. Businesses of that size make up 60% of the sample this year and that has been approximately the case over the whole history of the Wet Leisure Industry Survey.

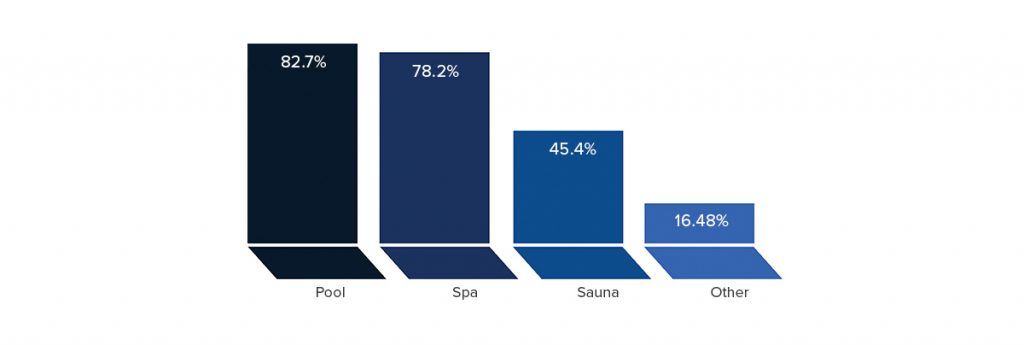

Which sectors of the wet leisure industry do you serve?

Last year the spa sector had inched ahead of the pool sector but in this year’s survey we see pools returning to the top spot.

Of the 16.5% of respondents who ticked the ‘Other’ box, the vast majority of them were involved in steam installations.

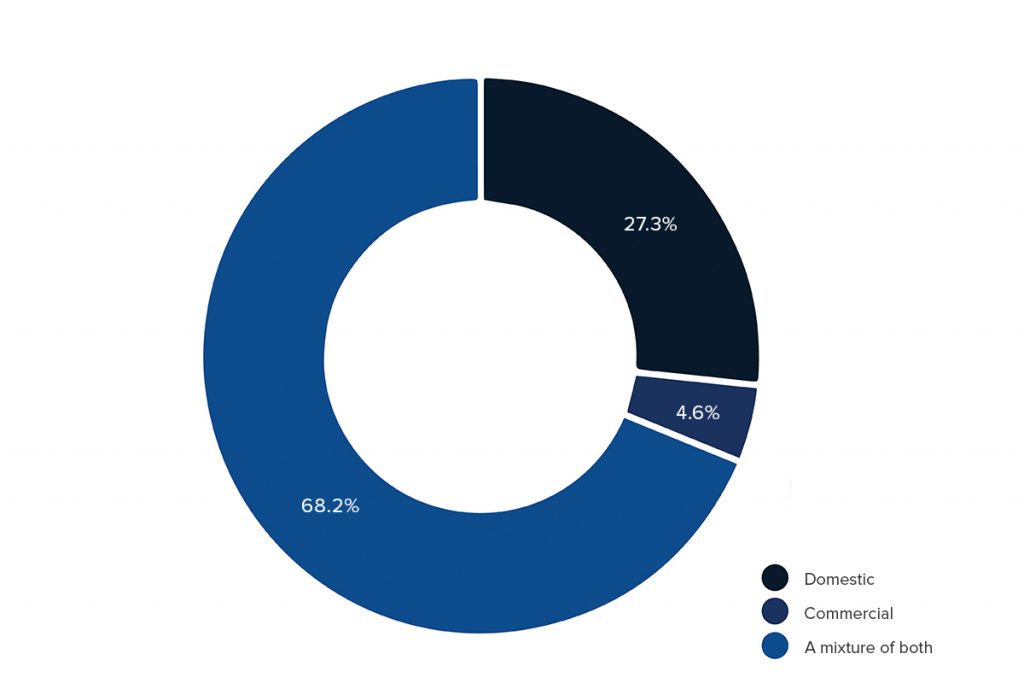

Are your customers and clients domestic, commercial or a mixture of both?

Once again we see growth in the purely commercial sector, up from 2% in previous years to 4% last year and 4.6% in this year’s survey.

The importance of pools, spas and saunas to the holiday accommodation industry has certainly been growing to the extent that one respondent to this year’s survey said, “There is a growing need for recognising the growth in holiday rental maintenance and guest change over services.”

Looking into the numbers a little deeper we can see that the respondents dealing purely with the commercial sector focus on service, repair, maintenance and refurbishment, as might be expected and they work predominantly in the pool and spa sector.

What are the services that you offer your customers? Check all that apply.

The overall shape of this graph has stayed broadly similar since the Survey began and that is only to be expected.

What is worth pointing out is that Showroom Sales has dipped to an all time low of 45%. This follows a trend that has been visible since the Survey began.

Service and Repairs continues to be the dominant activity in the industry as it has been since 2013 when it overtook Installation.

Under the Service and Repair heading we can probably put a host of separate activities; commercial maintenance contracts as well as domestic ones, holiday rental maintenance and commercial and domestic pool refurbishment. This last category – refurbishment – has grown strongly within the industry and has provided work for many businesses.

An indirect benefit of refurbishment is that the work often makes pools more energy efficient, reduces their chemical usage and extends filter life, making them more environmentally friendly. However, looking long term into the future, it might be possible that this activity could start to show an affect on sales of Consumables.

In summary.

When we look at the sort of businesses who responded to the Wet Leisure Survey and accept that they are a representative sample of our industry then what overall picture do we see?

Wet leisure appears to be a reasonably mature and stable industry. Compared to seven or eight years ago there are relatively few fluctuations in the aspects of the business that these first five questions examine; the relative strength of each region, the number of employees, the sectors served and services offered.

2018 certainly held many challenges for businesses across all sectors of the UK economy but it seems that they have at least not changed the overall shape of our industry. In that regard, we have successfully weathered a stormy year.